Regulating ‘Junk’ Fees Is Not the Way to Help Bank Customers

Payment services are a prevalent and necessary part of the U.S. economy. Statistics show that 83 percent of Americans carry at least one credit card, with the average American having up to three. Roughly 93 percent of consumers have a debit card. The cashless methods imposed during the COVID-19 pandemic solidified credit and debit purchases as standard practice, and buy-now buttons and tap-to-pay point-of-sale systems have enabled frictionless payments for daily transactions.

In addition to improvements in purchase options, making payments on bills has also become easier with automatic withdrawals, electronic transfers, and overdraft protection services. Banks and creditors are also more likely than ever to send notifications and reminders to ensure consumers don’t overlook a payment or incur penalty fees.

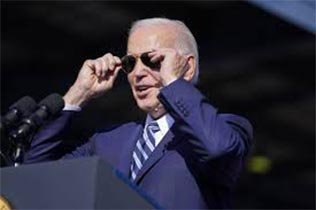

Yet, despite such advancements in payment and consumer engagement capabilities, the Consumer Financial Protection Bureau (CFPB) is aiming to intervene in credit dealings, and the Biden Administration has made it clear that banks should be viewed as bullies at odds with their members. The President has claimed that banks engage in “exploitation” via their service and that their fees for overdrafts and late payments should be reined in. And, given the CFPB’s track record for interfering with fee-related charges, the agency is eager to engage.

As part of the Federal Reserve, the CFPB purports to protect consumers from unfair or anticompetitive practices within the financial sector, but its efficacy here is debatable. For instance, the Federal Reserve recently sought to impose price caps on interchange fees, claiming that it would encourage competition and lower costs for both merchants and consumers. History proves the opposite to be true when the government gets involved. A case in point is the Durbin Amendment, which went into effect in October 2011 and set a cap on interchange fees at a flat rate of $0.22 per transaction. Although the price cap lowered marginal costs for merchants, the cost for banks was significant, with an annual loss of $6.5 billion. As a result, banks sought to offset the difference, and, according to a study published by the University of Pennsylvania, the share of free basic checking accounts requiring $0 monthly minimums decreased from 60 percent to 20 percent. Checking account fees increased from an average of $4.34 monthly to $7.44 monthly, and the monthly minimums for avoiding such fees went up by roughly 25 percent. Finally, monthly interest fees on checking accounts jumped to around 13 percent while any special offers banks had previously associated with opening an account were rolled back.

In short, the price caps resulted in fewer options for consumers and higher costs overall.

Thanks to the Durbin Amendment, 90 percent of banks were forced to raise their costs for consumers and restrict rewards programs for their patrons to make up for the loss incurred by the interchange caps. Consumers who previously enjoyed accruing points or getting cashback on their purchases were now unable to do so. Many banks did away with free checking accounts, which hurt lower-income households the most. Families with little means had fewer choices for safeguarding their earnings and resorted to using riskier services, like payday lending, to attain financing for whatever needs they were experiencing.

The Durbin Amendment over-promised and under-delivered, and the same will be true for the policies the CFPB is proposing today. When it comes to cost-savings for consumers, it should be obvious that doubling down and tightening the caps will only lead to more problems. Cause and effect will always exist, regardless of good intentions by Biden or the CFPB.

The Federal Reserve would best serve the American people by rejecting any proposal that interferes with price setting, and instead restoring competition in the financial system by letting merchants, credit card companies, and banks determine how best to handle the costs of their transactions and letting consumers choose which to use accordingly.

Content syndicated from Fee.org (FEE) under Creative Commons license.

Agree/Disagree with the author(s)? Let them know in the comments below and be heard by 10’s of thousands of CDN readers each day!