Housing Market Is About To Fall Off A Cliff, Economist Says

The price of residential homes could fall by as much as 20% next year off the back of mortgage rate hikes that are reducing demand, said Ian Shepherdson, chief economist of Pantheon Macroeconomics.

With mortgage rates at their highest level since 2002, current homeowners are unlikely to purchase a new property unless out of absolute necessity, said Shepherdson, according to CBS News. Housing prices were up 13% annually in August, down from 15.6% annually in July, the largest monthly decline in annual price growth in the more than 27-year history of the S&P CoreLogic Case-Shiller Home Price Index, S&P reported Tuesday.

“[W]e expect home sales to keep falling until early next year. By that point, sales will have fallen to the incompressible minimum level, where the only people moving home are those with no choice due to job or family circumstances,” said Shepherdson, according to CBS News. “Discretionary buyers are disappearing rapidly in the face of the near-400 [basis point] increase in rates over the past year.”

Economists for investing giant Goldman Sachs predicted a more modest decline in housing prices of between 5% to 10%, according to an Oct. 6 report. Goldman economists noted that “the housing market is tight, mortgage quality is solid and a large proportion of the mortgages have a fixed rate.”

As of September, the median existing-home sales price hit $384,800, up 8.4% from $355,100 in September 2021, according to the National Association of Realtors. A 20% decline from this price would see the median existing-home sales price fall to $307,840.

Elevated mortgages contributed to a 38% annual decline in demand for new mortgages and an 86% annual decline in demand for refinancing as of the week ending Oct. 15.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.

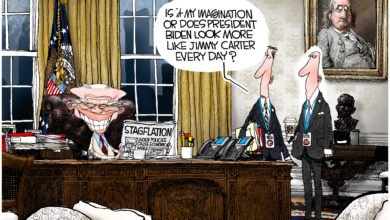

The government can’t seem to stop their endless money printing for their idiotic programs. Like the laughably called “Inflation Reduction Act” which is nothing but a 730 billion “Green New Deal” slush fund that will only increase inflation. Or Biden’s illegal student loan “forgiveness” which is projected to cost another 400 billion. No matter what the Democrats are telling you we are already in a Recession and it’s not unlikely that a Depression may be coming. Why? Because the only government response to our massive inflation and uncontrolled government spending is to rapidly increase interest rates which they are now doing. If you don’t remember then go look up mortgage rates in the 1970’s that were as much as 17% under Carter. As we head that way, the now robust housing market will be crushed along with all industries, the jobs, and manufacturing that support it and the economy will crater and we will be looking at another collapse like 2008.