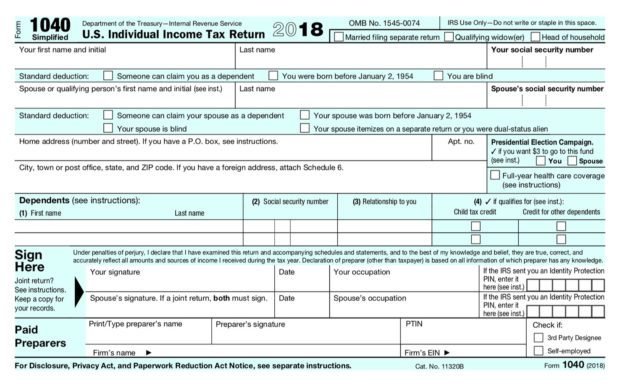

Treasury releases 2018 tax forms and they are much simpler [pics]

The U.S. Department of the Treasury released on Friday images and descriptions of the new 1040 tax return form saying that families will be able to file their 2018 income taxes on a “postcard-sized return.”

The new, less-complex form will be usable by an increasing number of Americans who no longer need to itemize thanks to the tax reform signed into law by President Trump.

“As the standard deduction is increased, fewer Americans will need to itemize, reducing the filing burden for tens of millions of families,” the department said in a statement.

The 2018 1040 “Simplified” form consists of two half-page sized pages.

“Cutting red tape has been a core tenet of the Trump Administration’s economic policies,” the department said in a statement. “The Tax Cuts and Jobs Act protects important benefits for both American families and businesses, while simplifying our tax code for the benefit of all taxpayers. While the Act includes $5.5 trillion in gross tax cuts, it also includes $4 trillion in reforms, including eliminating special-interest loopholes.”

The Treasury Department also noted what has and has not changed where deductions and tax benefits are concerned.

The mortgage interest deduction is being retained for newly-purchased homes of up to $750,000, while remaining intact for existing homes.

- Other important deductions maintained include the state and local tax deduction up to $10,000.

- The charitable giving deduction remains intact.

Many other vital tax benefits have been retained, including:

- The threshold for deducting medical expenses is reduced from 10% of AGI to 7.5% of AGI (the pre-Obamacare level) in 2017 and 2018, making it easier to claim the deduction

- Earned Income Tax Credit for low-income workers

- Child and Dependent Care tax credit

- Deduction for teacher out-of-pocket classroom expenses

- Retirement savings tax benefits

- Adoption expense tax credit

- Capital gains exclusion on home sales

- Tax-Free municipal bonds

- Private activity bonds