Income taxes

-

Money & The Economy

Feds Collected $34,400 Per Household In Taxes In 2023

The federal government collected approximately $34,400 in taxes per American household in calendar year 2023, according to data published by…

Read More » -

Opinion

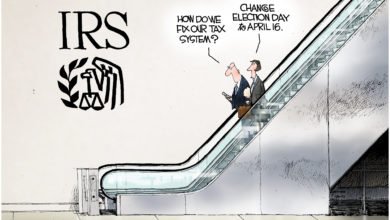

It’s Time To Switch From A Neiman Marcus Tax Code To A Walmart One

Tax Day, April 15, is always a good day to reflect on the things we value. For example, what do…

Read More » -

Opinion

It’s Tax Day. Most of Us Paid Too Much. So, How Will We Reduce the Deficit?

April 15th, Tax Day, is upon us (it’s April 18th this year.). That means our Federal Income Tax liability must be…

Read More » -

Opinion

A National Sales Tax is a Bad Idea. Here’s a Better One.

The Republicans recently suggested replacing Federal income taxes with a 30% sales tax on all consumption. After careful consideration, the…

Read More » -

Opinion

Billionaire Tax is Wrong, Unfair and Counter-Productive

President Biden has just released his proposal for the Federal government’s budget for fiscal year 2023. In spite of an…

Read More » -

The simple and fair solution to having wealthy Americans pay their fair share

A recent report from Propublica, indicated that some of the wealthiest Americans paid little or no federal income taxes in certain…

Read More » -

Money & The Economy

IRS to Delay Tax Filing and Payment Deadline by More Than a Month

The Internal Revenue Service announced Wednesday that it would delay tax filing and payment due dates until Mid-may due to…

Read More » -

Raising The Capital Gains Tax Rate Will Contribute To The Biden Stagflation

Recently economists have begun to worry about stagflation. That is a condition where the economy is not growing (stagnant) while…

Read More » -

Opinion

I Could Pay Off My $50k Student Loan in a Few Years—if Government Stopped Taking My Money

Twelve-thousand dollars. That’s how much the government will take out of my income this tax season. As a college graduate,…

Read More » -

Georgia Matters: Biden Pledges To Hike Taxes to Bush Administration Levels

President-elect Joe Biden in a Wednesday interview said “there’s no reason why” his administration shouldn’t raise both corporate and individual…

Read More » -

Opinion

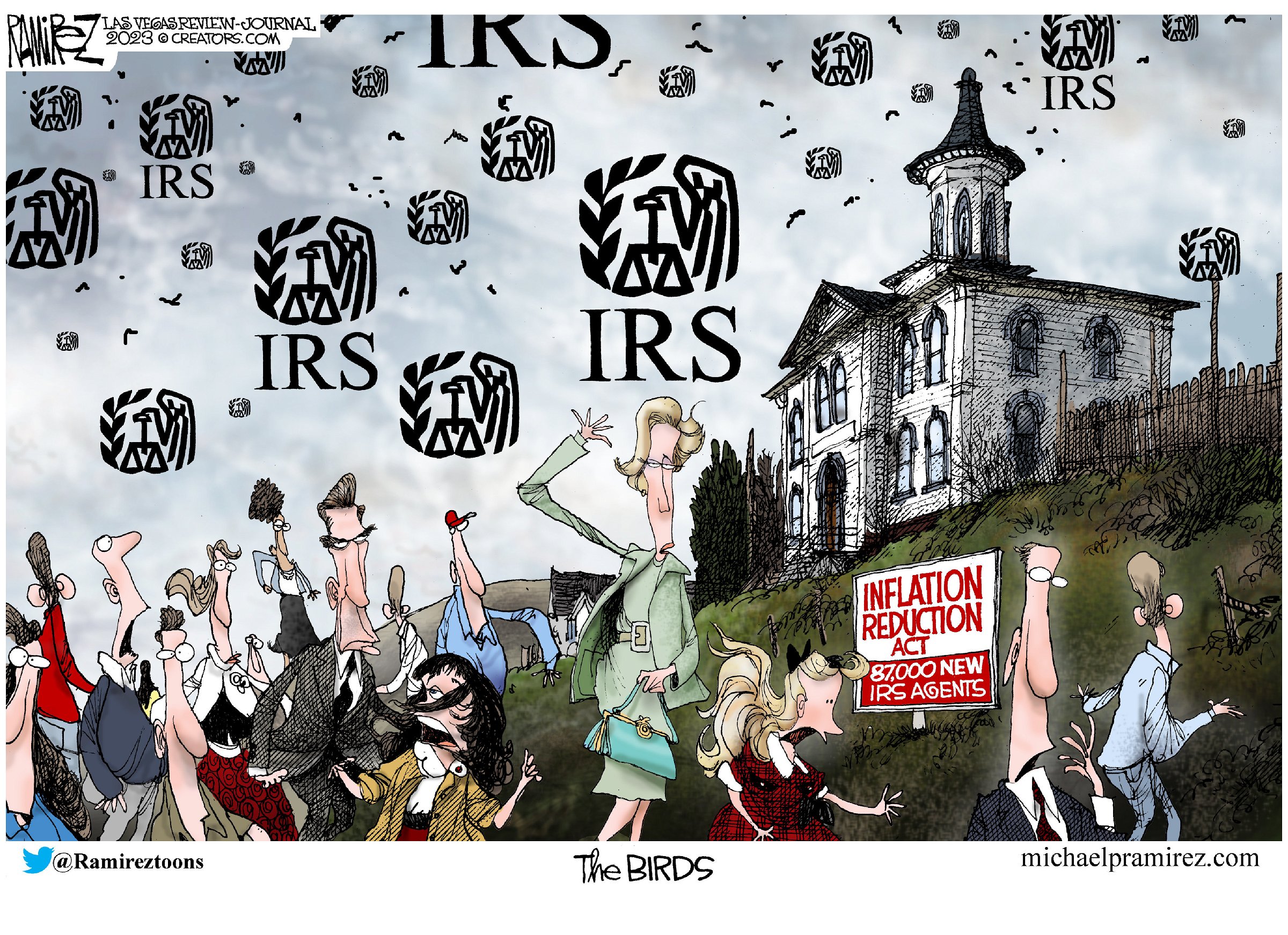

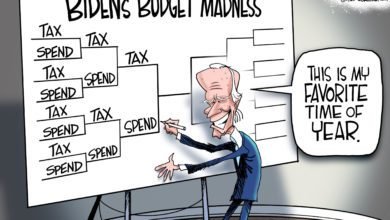

Democrats: Tax and spend. Here we go again.

During a presidential debate on October 28, 1980, candidate Ronald Reagan listened to the responses that President Jimmy Carter gave…

Read More » -

In The News

Despite Biden’s claims, Trump tax cut did not add one penny to the deficit

Assumed Democratic Presidential candidate Joe Biden has already promised to get rid of the Trump / GOP tax cut legislation of 2017.…

Read More » -

Money & The Economy

As Taxpayers Start Feeling Impact of New Tax Law, Here’s Who Could Win Big

A list of taxpayers who stand to benefit the most from the Tax Cuts & Jobs Act as they begin…

Read More » -

In The News

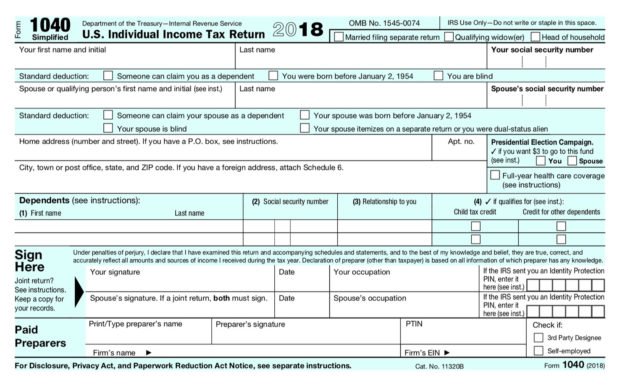

Treasury releases 2018 tax forms and they are much simpler [pics]

The U.S. Department of the Treasury released on Friday images and descriptions of the new 1040 tax return form saying…

Read More » -

Money & The Economy

Where Does the Federal Government Get All That Money?

Did you know that the U.S. federal government collects more than $3 trillion in taxes each year? Where does all…

Read More »