Stock Market

-

Money & The Economy

Biden’s Bear Market Could Last a Year

It’s official: the bull market in stocks ended Friday as the S&P 500 accumulated a 20.7% loss from its January…

Read More » -

Money & The Economy

Stock Market Plummets As Russia Invades Ukraine

Stock markets plummeted Thursday after Russia invaded Ukraine, causing global energy prices to surge and equity markets to plunge, multiple…

Read More » -

Money & The Economy

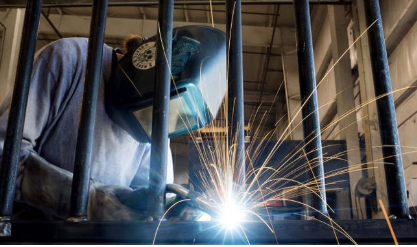

Why U.S. Steel’s stock buyback is such a big winner

Stock buybacks have been criticized by those who opposed the 2018 tax cuts passed by Congress. The opposition says that…

Read More » -

Stock Market Plunges As Investors Fear Increasing Coronavirus Cases

Stocks plummeted throughout the morning and afternoon Monday as U.S. investors feared the negative economic effects of rising coronavirus cases.…

Read More » -

Money & The Economy

What They Don’t Want You to Know: How a Teacher Went from Making $60k a Year to $336k

The American marketer and venture capitalist Guy Kawasaki once observed that the best way to make money is by making…

Read More » -

Money & The Economy

Dow Jones Stock Market Index Hits All-Time High, Surpasses 30,000

The Dow Jones Industrial Average surged more than 400 points Tuesday morning surpassing 30,000 for the first time in the…

Read More » -

Opinion

Fraud From The Great Wall Hits Wall Street

U.S. investors recently learned a hard lesson about Luckin Coffee, a strong rival to Starbucks in China. The company admitted…

Read More » -

US News

Trading Halted As Stocks Nosedive Over Coronavirus Fears

The New York Stock Exchange (NYSE) paused trading on Monday after stocks plummeted more than 10% over coronavirus concerns, triggering…

Read More » -

US News

US Stocks Had Their Best January In 30 Years And China Deal Could Keep It Going, Says Stuart Varney

U.S. stocks had their best January in the last 30 years and President Donald Trump’s potential trade deal with China…

Read More » -

Money & The Economy

Varney Explains Stock Dive: Not a Sign of a Recession

Fox Business host Stuart Varney explained why the stock market dropped nearly 800 points on “Fox & Friends” Wednesday and…

Read More » -

Money & The Economy

Stocks React as Trump Threatens Tariffs on All Chinese Imports

Stock market index futures initially dropped in early Friday trading after President Donald Trump issued another threat to China over…

Read More » -

DOW Falls Off A Cliff — 1,000 Point Market Correction Breaks Uninterrupted Growth Streak

by Jack Crowe The Dow Jones Industrial Average fell precipitously Monday afternoon, continuing a market correction that began Friday…

Read More » -

As Trump tweets, so goes the market

To paraphrase a famous cliché, “As Trump tweets, so goes the stock market.” Last Thursday, Japanese car maker Toyota’s stock…

Read More » -

In The News

The Stock Market: Three Days Post Election

FRIDAY 10:30 AM. The graph is obvious. Three days after the reelection of Barack Obama the stock market is still…

Read More » -

“Why I DON’T Like Facebook” for Investment

ATLANTA, May 18, 2012 /PRNewswire-USNewswire/ — Crown Financial Ministries CEO Chuck Bentley outlined reasons that should concern investors who plan on “liking” Facebook for their…

Read More »