retirement

-

Money & The Economy

House Swiftly Passes Key Tax Benefits For Retirement Accounts. Here’s How It Works

The House of Representatives passed a bipartisan bill Monday providing massive tax benefits for American workers’ retirement savings accounts. The…

Read More » -

Money & The Economy

Nearly 7 In 10 Retirees Say They Live As Well Or Better In Retirement Than During Their Working Years

More than two-thirds of retirees say they live as well or better in retirement as they did when they were…

Read More » -

In The News

Watch Live: President Trump Participates in a Signing Event on Strengthening Retirement Security in America

President Donald Trump signs an executive order that strengthens retirement security for Americans on Friday afternoon in Charlotte, North Carolina.…

Read More » -

Money & The Economy

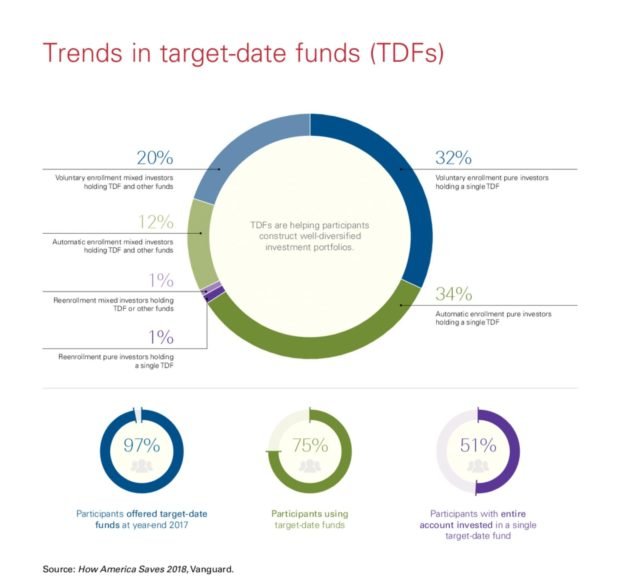

More Than Half Of 401(k) Participants Invest In A Single Target-Date Fund

Vanguard reports that more than half of 401(k) participants are now invested in a single target-date fund (TDF), compared to…

Read More » -

Money & The Economy

Gig Economy May Replace Retirement for Many

Today, more than one in three U.S. workers are freelancers — and this figure is expected to grow to 40 percent…

Read More » -

In The News

The Stock Market: Three Days Post Election

FRIDAY 10:30 AM. The graph is obvious. Three days after the reelection of Barack Obama the stock market is still…

Read More » -

Retirement Planning at 40-Something – Halftime of the Big Game

LUBBOCK, Texas, Sept. 11, 2012 — If you started retirement planning early in your career, it’s good news by the…

Read More » -

Feds Targeted for $600M in Improper Retirement Payments

“Feds Targeted for $600M in Improper Retirement Payments” An Extremely Deceiving Headline By Dell Hill When Fox News first reported…

Read More » -

New Mobile Technology Transforms How America’s Workers Save for Retirement

Innovative Financial Advisors pilot cutting-edge process resulting in dramatic improvements in retirement savings SANTA ROSA, Calif., Aug. 31, 2011 —…

Read More » -

Darning The National Fabric

Our country is stumbling blindly down an unsustainable path. While much is being made about the National Debt and how…

Read More » -

The Alliance Interview – In-Depth Look into Conservative Alternative to AARP

On Monday, I had the opportunity to spend a little under an hour with the President of The Alliance for…

Read More »