Health insurance

-

Opinion

A Plan You Can Actually Keep: Trump Delivers On Obama’s Broken Health Care Promise

Sometimes, liberals and conservatives agree on a policy problem, but disagree strongly on the best solutions to that problem. Our…

Read More » -

Opinion

Medical Migrants Head to Mexico

There’s hope for price competition in healthcare, but so far only with companies that self–insure by paying for all employee’s…

Read More » -

Opinion

Democrats Plan To Take Away Our Insurance And Give It To Illegals

The Following Article Appeared in Breitbart by writer John Note explaining how the Dems plan to take away our health…

Read More » -

Opinion

Sen. Mike Braun’s Backwards Healthcare Reform

Two years too late a senator has finally taken a tentative step toward increasing competition in the healthcare market, lowering…

Read More » -

Science, Technology, and Social Media

Insurance Companies Could Start Tracking Social Media Accounts To Determine Premiums

“Fox & Friends” contributor Kurt Knutsson said insurance companies will likely start looking at social media accounts to determine premiums…

Read More » -

Money & The Economy

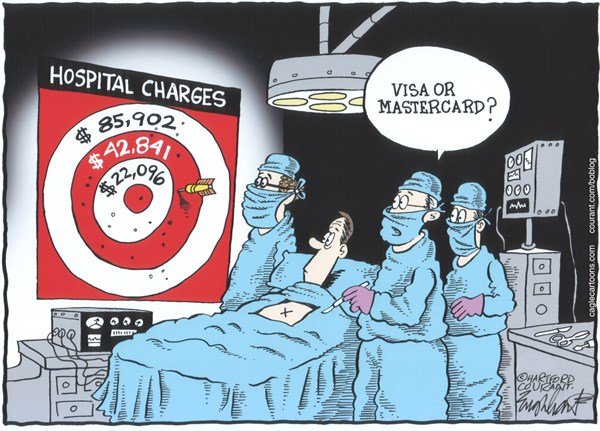

Health Insurance Premiums Have Increased 62 Percent Since the First Obamacare Open Enrollment Period

Today eHealth, Inc. (NASDAQ: EHTH) released its annual Health Insurance Price Index Report for 2018, tracking costs and trends for major…

Read More » -

Opinion

California Reinvents Medical Tourism

Until very recently medical tourism was traveling from your home to find less expensive medical care, usually overseas. Medical tourists…

Read More » -

Opinion

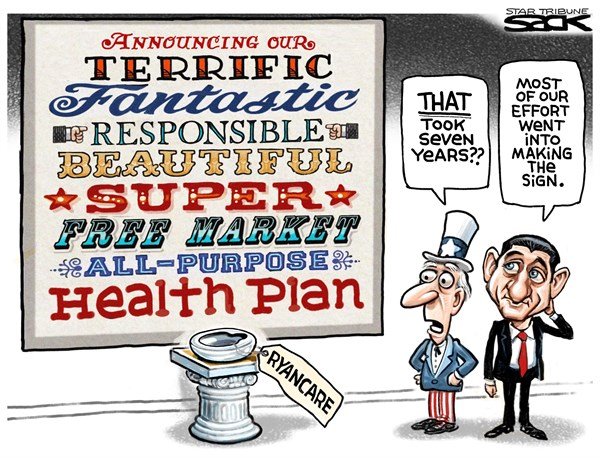

Ryan’s Obamacare Lite Is Another Travesty & Betrayal

Freshman Rep. Moira Walsh had an unusual explanation for some of the bad lawmaking in her state capital during an…

Read More » -

Opinion

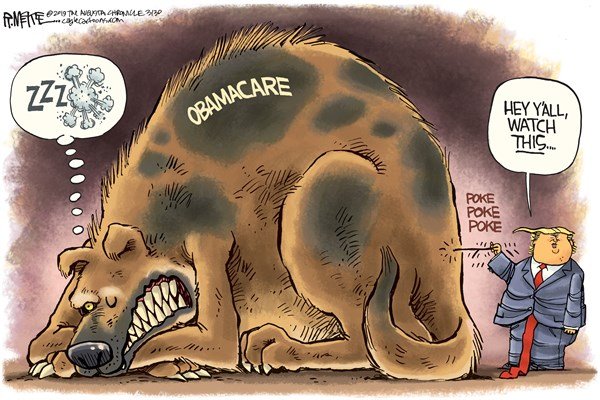

Establishment Republicans Risk Achieving a Progressive Dream

One of the motivating factors of those who chose to vote for Donald Trump in the 2016 General Election was…

Read More » -

Opinion

Something Wicked This Way Comes

As we approach the dreaded tax filing deadline of April 15th, many Americans are ill-prepared for the news they are…

Read More » -

How Obamacare Screws the Working Class…Hard

Now that it is becoming clear that the establishment House Republicans are about to capitulate to the Senate Democrats and…

Read More » -

Dispensing with the ‘It’s the Law’ Rhetoric

Over the past few months, Progressives and Democrats who favor the Affordable Care Act (Obamacare) – both elected and not…

Read More » -

Money & The Economy

Single Democrats? Here’s Your New Health Insurance.

Do you know any young single Obama voters? Maybe the guys and gals who were excited about their “free” contraceptives…

Read More »