Money & The Economy

News on Finance, Money, markets and the economy

-

Gov’t Jobs Continue To Swell Under Biden As Unemployment Ticks Up

The U.S. set another new record for the total number of government jobs in February, even as overall unemployment ticks…

Read More » -

Layoffs Surge For Another Month Despite Job Gains

Layoffs at U.S. companies surged for another month as businesses adjusted to current market conditions, despite huge reported job gains,…

Read More » -

No Joe, price gouging, shrinkflation are not the problems

Recently President Joe Biden said that he will take action to reduce high prices. He notes that prices, on average,…

Read More » -

Americans Feel Lousy in Biden’s Good Economy

President Biden cannot understand why the approval rating on his handling of the economy is so low. About two-thirds of Americans call…

Read More » -

Companies Increasingly Turning To Cheap Foreign Labor As Rising Costs Take Their Toll

Business owners are increasingly utilizing foreign-born migrant labor to meet their working needs as sky-high inflation pushes up the costs…

Read More » -

Local Restaurants Can’t Keep Up With Minimum Wage Hikes, Inflation

Minimum wage hikes in many states around the country and sky-high inflation are crushing independent restaurants that don’t want to…

Read More » -

US’ ‘Greatest Economic Resource’ Is Declining, And It Could Spell Trouble For The Economy

The steady decline of birth rates in the U.S. creates considerable concerns for the future of the American economy, which…

Read More » -

High Rent Prices Are Crushing Americans — And They Could Be Here To Stay, Experts Say

Rent prices have exploded since the end of the COVID-19 pandemic and are unlikely to moderate, with shortages in supply…

Read More » -

Stagflation may be here by late summer

As economic growth slows and inflation rises, the economy could see stagflation – a condition where economic growth stalls, yet…

Read More » -

What Nvidia’s Meteoric Stock Rise Says About The Future Of The Economy

Nvidia posted huge fourth quarter results on Tuesday, up 265% from one year prior, launching the largest one-day single-stock rally…

Read More » -

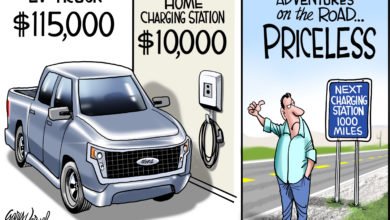

Mercedes-Benz Walks Back Huge Electric Vehicle Commitment Amid Slowing Demand

Mercedes-Benz on Thursday walked back plans to have an all-electric line-up by 2030 as consumers decline to adopt electric vehicles…

Read More » -

Germany Likely In Recession, Central Bank Partially Blames Green Agenda

Germany appears to be in a technical recession thanks in part to climate policies, according to the country’s central bank.…

Read More » -

‘Serious Problems’: Global Plague Of Recessions Could Infect US, Experts Say

Top U.S. trading partners, including the U.K., Germany and Japan, have recently entered recessions as inflation and high interest rates…

Read More » -

Electric Vehicles Are So Unpopular That Entire Mines Are Shutting Down

A slowdown in the growth of electric vehicle (EV) demand has led to entire mines being shut down as the…

Read More » -

Ridiculous Trump Verdict Catastrophic for US Economy

Recently a New York state judge ordered Donald Trump to pay $364 million as part of a fraud trial against him and…

Read More »