Money & The Economy

News on Finance, Money, markets and the economy

-

Top Wall Street Economist Delivers Grim Prediction On Future Recession

Andrew Hollenhorst, chief U.S. economist at Citi, predicted on CNBC Thursday that the American economy is headed for a recession,…

Read More » -

America’s Job Gains Reaped Largely By Immigrants, Analysis Finds

The number of immigrants working in the United States increased over the past four years while the number of working…

Read More » -

Retail Sales Decline In January As Americans’ Economic Woes Persist

Consumers cut back on retail spending in January as factors like inflation and high credit card debt weighed on Americans,…

Read More » -

Inflation Missed Expectations In January. Are We Just Stuck With High Inflation Forever?

The Bureau of Labor Statistics announced on Tuesday that inflation increased at a 3.1% annualized rate in January, despite widespread…

Read More » -

Rich Investors Are Scooping Up Cheap Property As Commercial Real Estate Sector Suffers

Investors flush with cash are looking to buy up commercial real estate properties that developers are putting on the market…

Read More » -

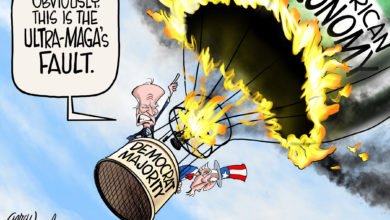

US Stocks Tumble After Inflation Comes In Above Expectations

Major U.S. stock indexes finished the day Tuesday with huge losses as investors reacted to inflation data that cast doubt…

Read More » -

Everything You Need To Know About The Potentially Seismic Sale Of US Steel

The potential sale of one of America’s largest domestic steel producers, U.S. Steel, has raised eyebrows among lawmakers in key…

Read More » -

Credit Card Debt Indicative of Inflation Psychology

When the Federal Reserve paused its interest rate increases last September, I worried that it stopped raising rates too soon.…

Read More » -

Here’s The Domino That Could Kickstart Another Banking Crisis

Smaller banks hold a disproportionate amount of commercial real estate loans compared to all other loans, according to data from…

Read More » -

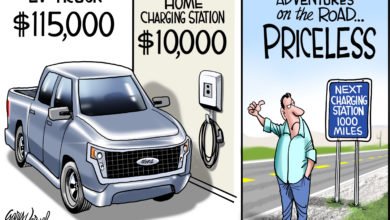

One Major Manufacturer Resisted EV Mania. Now, It’s Raking In The Cash While Competitors Take Losses

Toyota drew activist criticism when it did not quickly embrace electric vehicles (EVs) like many of its major competitors, but…

Read More » -

Boeing Pauses Deliveries For Dozens Of Planes Due To Newly Discovered Issues

Boeing said in a memo to staff on Sunday that a supplier’s employee found misdrilled holes on some fuselages for…

Read More » -

Latest Data Indicates No Rate Cuts Anytime Soon

Most Americans – including most of those on Wall Street – believe that the Federal Reserve will cut interest rates…

Read More » -

Full-Time Work Is Being Replaced By Part-Time Jobs As Americans And Businesses Struggle

Since June 2023, Americans have been increasingly employed in part-time positions, with a subsequent decline in full-time work, according to…

Read More » -

One Missing Line From The Fed’s Big Statement Could Spell Trouble For The Economy

The Federal Reserve excluded one key line from its Wednesday interest rate decision announcement, indicating possible trouble in the ailing…

Read More » -

Economic Growth Is Strong. Why? And What’s Next?

The Bureau of Economic Analysis recently announced that GDP growth in the fourth quarter of last year was 3.3%. That meant for…

Read More »