Here’s Why You and Your Spouse are Sitting Around the Table Figuring Out How to Make Ends Meet

You already know that groceries are significantly more expensive than they were pre-Biden. You already know that fueling up your car is more expensive. But American families were (barely) making it when those things were already true. So why are you and the Mr. or Mrs. scratching your heads, late at night trying to find an extra $100, $200, or $300 a month to afford the exact same lifestyle you’ve had for decades?

You aren’t going on fancy vacations, you aren’t buying lavish furniture or decorations. So, where is the money going?

Everywhere – all at once.

Neo-Keynesian ‘Economist’ and leftist political hack Paul Krugman declared Thursday that “we won” the battle against inflation. Do you feel like things are more affordable now? No? Shocker!

Of course, unlike Krugman’s waaaay overpaid butt, we have to actually buy food, energy, housing, and vehicles and are sensitive to price increases.

There isn’t anything that has gotten cheaper. Check your car insurance bill, your home insurance bill (or your escrow payment if you still have a mortgage). That’s on top of interest going up if you have to stretch out a propane payment or finance a replacement for the stove that just went belly up. Everything, everywhere is more expensive – but why?

Your car and home insurance are going up due to the massive crime wave caused by soft-on-crime progressive district attorneys deciding not to prosecute things like property crimes. That means that criminals feel more empowered to steal more cars (carjackings are skyrocketing), rob more homes, and steal more stuff (you’ve seen the mobs of thieves hitting stores). Well, when insurance companies have to reimburse those losses (claims), there is only one place they can go to get the money to do that – your premiums.

You are literally paying for the Democrats’ crappy policies on crime. I am sure they see this as wealth redistribution, providing bread to needy families, or some other such garbage.

Finance charges going up is 100% due to the government shoving way too much money into the economy in the form of stimulus payments, massive infrastructure programs, and green energy boondoggles which all cause massive inflation. Then the Federal Reserve has to react by raising rates. Those rates determine everything from credit card interest to home mortgage interest to in-store financing for the refrigerator you had to buy to replace the one that died. In this instance, you are paying for the government’s inability to keep its wallet in its pants.

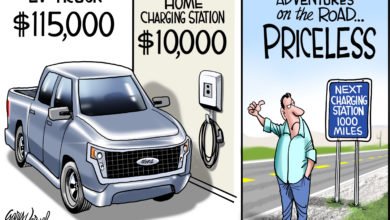

Also, it’s not as cheap to maintain that 10+-year-old car you’re keeping around because you can’t afford a new car at these prices (most of us can’t) and the unions are about to send those prices into the stratosphere (or car companies overseas). Anyone that is financing a new car at these high interest rates is committing financial suicide. Government regulations that require cars to do things that not all of us really need drive up the price of cars. Tack that on to world-leading labor costs and all that has to get paid for by someone. Umm, you. (seeing the trend yet?)

More Americans are holding on to older cars longer because they don’t have a choice. That means more demand for repair services and repair parts driving up the cost of both parts and labor. Have you noticed the backlog at your favorite mechanic’s shop?

So, as you and the most important person in your life review your list of monthly bills, scour your budget for some savings, stare blankly at a spreadsheet you no longer know how to balance, or decide that a second job is the only answer – realize that it was all brought to you by… the government.

Remember, “Bidenomics is working.”

Elections matter.

P.S. You know how I know? Because my wife and I are doing this too.

Agree/Disagree with the author(s)? Let them know in the comments below and be heard by 10’s of thousands of CDN readers each day!

Content created by Conservative Daily News and some content syndicated through CDN is available for re-publication without charge under the Creative Commons license. Visit our syndication page for details and requirements.