One could almost hear the howls of laughter emanating from the hallways of major oil companies and analyst firms in August when the increasingly politicized International Energy Agency published a report projecting that global demand for crude oil would peak by 2030. Last week, the agency doubled down on that prediction, going further to add similar predictions about natural gas and coal demand in its Global Energy Outlook for 2023.

“A legacy of the global energy crisis may be to usher in the beginning of the end of the fossil fuel era: the momentum behind clean energy transitions is now sufficient for global demand for coal, oil and natural gas to all reach a high point before 2030 in the STEPS,” the report’s executive summary says, referring to its Stated Policies Scenario (STEPS). That scenario, one of several the agency ran through its statistical model, is supposedly based on energy, climate, and industrial policies already in place in countries around the world.

But, while policies can influence markets, they seldom dictate outcomes, and even in totalitarian nations, the ultimate outcomes really tend to be entirely unpredictable. See the outcomes experienced by the people of Venezuela during the Nicolas Maduro regime as a prime example.

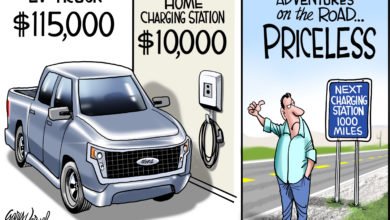

Citizens in the U.S. are seeing similarly unpredictable and unintentional outcomes arising in America’s energy sector, despite the hundreds of billions of dollars in federal subsidies enacted in the Orwellian-named Inflation Reduction Act. Not a single proponent of those debt-funded subsidies predicted that, within a year of the bill’s enactment, Big Wind companies would be asking for state and federal bailouts, or that the electric vehicles sector would now be experiencing major headwinds in demand.

Given these realities, it is not surprising that few in the business community give much credence to the IEA’s latest report. Chevron’s CEO Mike Wirth, whose company announced a major acquisition of Hess Corp. on October 23, was blunt in his disagreement with the report. ““I don’t think they’re remotely right ,” he told the Financial Times. “You can build scenarios, but we live in the real world, and have to allocate capital to meet real world demands.”

Writing at Oilprice.com, Cyril Widdershoven, a senior researcher at Hill Tower Resource Advisors, also panned the IEA peak oil projection. “The current IEA report appears to resemble a modern-day version of “Crying Wolf,” he says. “It’s possible that the underlying strategy of Paris and its supporters is to induce significant fear among investors, including clients, in the hope that their biased outlook becomes a reality. However, at present, such a scenario appears unlikely.”

The reality is that real-world demand for oil continues to rise, and there is no real reason to expect it to peak and begin dropping anytime soon. In its own 2023 Annual Report, OPEC paints an entirely different view for the future of global crude demand. That report projects oil demand to reach 116 million barrels per day (mbd) by 2045 under its main scenario, a 16.5 percent rise from the 99.4 mbd in 2022.

In its own Short Term Energy Outlook published October 11, the U.S. Energy Information Administration projects no near-term slowing in crude demand, projecting 2024 demand to achieve yet another all-time high based on a projected average Brent price for crude of $94.91 per barrel.

The recent big acquisitions announced by Chevron and ExxonMobil (buying Pioneer Natural Resources) are indicative of an oil and gas sector planning for long-term demand growth. Andrew Dittmar, Senior Vice President at Enverus Intelligence Research (IER) told me in an email that, “the common thread connecting these deals is majors looking to refill their pipelines to maintain production against a declining asset base as they anticipate their legacy businesses staying profitable into the 2030s.” Even more than that, Dittmar adds that the deal “indicates buyers are starting to place a higher focus on growth after years of solely looking to grow shareholder distributions.”

That take appeared to be confirmed this week by rumors circulating that ConocoPhillips is looking at buying privately-held CrownRock LP, a large independent producer focused on the Permian Basin.

The bottom line is an American oil and gas industry focused on growing for the future, and no amount of IEA reports are likely to change that reality anytime soon.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org

Agree/Disagree with the author(s)? Let them know in the comments below and be heard by 10’s of thousands of CDN readers each day!