1099-NEC: Bow before your Master

We’ve all been through the financial roller-coaster: when times are tough, you tighten your belt; when times are good you save, and you might indulge a bit.

10 out of 9 people agree (House Ways and Means Methods of Accounting). Even politicians agree! But only when it comes to individuals, of course.

Businesses should not lay off a single employee, still pay them high wages regardless of attitude, skillset, or actual contribution, and keep up with (I use a strobe) expensive regulations that seem to be designed more to convince folks that Gum’ment™ is actually doing something, as opposed to being a bunch of tax-fattened hyenas voting themselves generous gifts from the treasury.

And DON’T YOU DARE RAISE YOUR PRICES TO ACCOMMODATE THIS. Not that I am bitter.

And when the economy is hurting, the government should do what? Borrow and spend more money. Run the presses! Print print print!

Why would the government ever cut a single cent from its budget?

In fact, when the government is struggling to pay for its wish list, it does what any other organized criminal organization does: goes harder after people that “owe” them money.

Seriously, why does a government that literally prints money out of thin air need to go after MORE from anyone else?

Between 2010 and 2017, the IRS has lost $2 BILLION in funding. Not lost like the Pentagon loses money, and can’t account for where it went

The claim is based on a quote from Donald Rumsfeld from September 10, 2001:

“According to some estimates, we cannot track $2.3 trillion in transactions.”

(As an accountant, this money may be “missing” as much as a result of sloppy reconciliation as opposed to “disappeared”. Not that this explanation is any less troubling.)

Lost, as in Congress cut their budget, so they had to reduce their employees, departments, and enforcement.

The IRS’s budget dropped over $2 billion in seven years. Remember this number; there will be a test shortly.

Despite the reduced budget and resources at the IRS, they still brought in more revenue under the Trump administration because prior to 2020, the economy was expanding. Still upset about mean tweets?

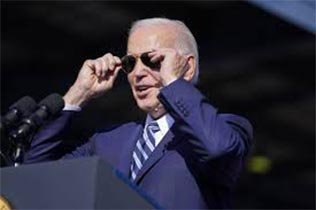

Under the Biden administration, we now have the“American Families Plan”. Please excuse me while I wipe this patriotic tear from my eye.

It’s a $1.8 trillion welfare expansion plan. Simply raising taxes back to 39.6% won’t fund it. How about spending $80 billion to “recover” $700 billion-that would offset the costs of the bill by nearly half.

Below is a grid (hey, I dig Excel) that shows the spending proposals on the left, and the noble “fundraising” measures on the right. Pay close attention to how the biggest revenue generator is tax enforcement:

Here's my tally of what's in the American Family Plan

Total spending of $2 trillion over the next decade offset by $1.7 trillion in taxes ($700bn of which isn't scoreable/claimed savings from enforcement) Resulting in net deficit expansion of $267 billion. pic.twitter.com/oTJ3rtdECb— Donald Schneider (@DonFSchneider) April 28, 2021

Now, look back at the $2 billion haircut the IRS saw over seven years and compare that to the $80 billion windfall this bill intends to give it.

Now, if an agency is bloated and needs to streamline its activities then why in the world would you consider running through “Buns of Steel”, dropping 50, and then go load up at the All-You-Can-Eat?

It’s expected to grow the IRS enforcement staff by nearly 15%.

The current annual funding for the IRS is $12 billion, with $5.2 billion allotted toward enforcement. $80 billion over ten years is $8 billion per year more toward just enforcement. That’s over two and half times what they are spending now.

The claim is that they are now going to hunker down and really go after the rich, the corporations, and offshore.

Wonderful.

But…the middle and lower class are the ones that have historically borne the weight of our government invoices. And it certainly seems that every time we are fist-pumping the air about “Tax the Rich” I have an additional letter in my mailbox-one that demands yet more money.

For those of you that are not following: I believe it to some degree. I do NOT believe that’s all they are going to do, however (!).

Any time you give the IRS — or any enforcement arm of the state for that matter — more money, they find ways to use it. (Budget Based Funding=Use It or Lose It).

The ways in which they use it often translate into a huge headache for financial institutions, banks, third-party payment providers, and anyone who uses any of those three things. And guess who they share that headache with, in the manner of increased prices, fees, and penalties?

…Lest we forget FATCA…

Do you use Zelle? Venmo? Cashapp? PayPal? Then you’re automatically entered into the IRS audit lottery: may the odds ever be in your favor

Among other things, that means banks and third-party apps will be required to give the IRS data about account holders’ “aggregate account outflows and inflows,” the Treasury Department said in a statement on Wednesday.

“This reform aims to provide the IRS information on account flows so that it has a lens into investment and business activity,” according to the Treasury’s statement. “Providing the IRS this information will help improve audit selection so it can better target its enforcement activity.”

I don’t even want to know what “other things” they were referring to when they said, “among other things”.

In case you thought that might not directly affect the middle class or the poor, you might want to go back and brush up on that particular historical chapter; reference a separate initiative called Biden’s “Rescue Plan”. (Sorry, got teary-eyed again).

I foamed at the mouth on this one in a previous two-parter; I will confess that the surprise twist at the end didn’t seem to catch anyone off guard.

You remember that one right? That was the $1.9 trillion bill that was supposed to help the recovery efforts from the pandemic, but cursory inspection showed only around 5% of it actually is allocated toward anything to do with the pandemic.

The rest is a series of gratuitous state bailouts, pet projects, and cronyism.

Within the bill was this little nugget:

Buried inside the 600-page bill that’s ostensibly meant to provide pandemic relief is a provision requiring gig economy platforms to report information to the IRS about all users who earn at least $600 in a year. Previously, platforms were only required to provide the IRS with information on users who made at least 200 transactions or earned at least $20,000.

Reporting someone for earning $600 in a YEAR, is asinine. And with $8 billion per year more in tax enforcement, you can bet there’s bandwidth to investigate.

Got some worse news-I just spent the first part of the year working as a phone tech of a well-known tax preparation software company-so I got some serious insight into what’s coming.

Think of all the people affected though. It wouldn’t take much to get to $600 in one year doing any of these things:

- Artisans selling their crafts on eBay

- Airbnb occasional renters

No one is suggesting that these peeps shouldn’t pay taxes on their copious stacks of moola earned. What’s being discussed is turning YOU into a reporting and tracking arm of the IRS- and penalties if you fail to perform.

The headaches just increased yet again. Now these above platforms have to enhance their reporting (and guess who is going to get into trouble if you forget to turn in someone that you coughed up a little to, that helped with a downed tree in your front yard?)

Remember, the IRS is getting $8 billion dollars a year… not all these businesses and individuals.

Read that again: The IRS is getting 8 bills to make sure that YOU are reporting taxable income numbers on other people.

This is not dissimilar to Germany jailing people for not reporting if a Jewish person was in the vicinity.

In the US, it cost $197.3 billion in tax compliance in 2019.

That number to go through the roof-and who will be left to pay the cost of that along with the droolingly insane amount of spending coming through congress?

For a president, and his followers, who insisted this is all about coming after the rich and the corporations, it certainly doesn’t look that way. Every time the taxes increase on the “rich” I end up having to cough up more in one way or another.

Basically, no one is safe: rich, poor, or anywhere between. Orange Man might have been bad, but Biden was not the solution to the problem.

Economically, every American person is in for it.

With the IRS emboldened, and the financial institutions, banks, third-party payment providers, and gig platforms scrambling to comply, it might actually be time to make plans to get as much out of the US.

By the way, (for the benefit of my dad) I have a riddle for you:

Q: Do you know what the difference between an insane, ludricris conspiracy theory and actual established fact is?

A: About six months.

Content syndicated from TheLibertyLoft.com with permission.