Social Security Administration Announces 2.0% COLA Increase

The Social Security Administration announced Friday that it will increase Social Security and Supplemental Security Income benefits for more than 66 million Americans by 2.0%.

“The 2.0 percent cost-of-living adjustment (COLA) will begin with benefits payable to more than 61 million Social Security beneficiaries in January 2018, SSA said in a statement. “Increased payments to more than 8 million SSI beneficiaries will begin on December 29, 2017. (Note: some people receive both Social Security and SSI benefits)”

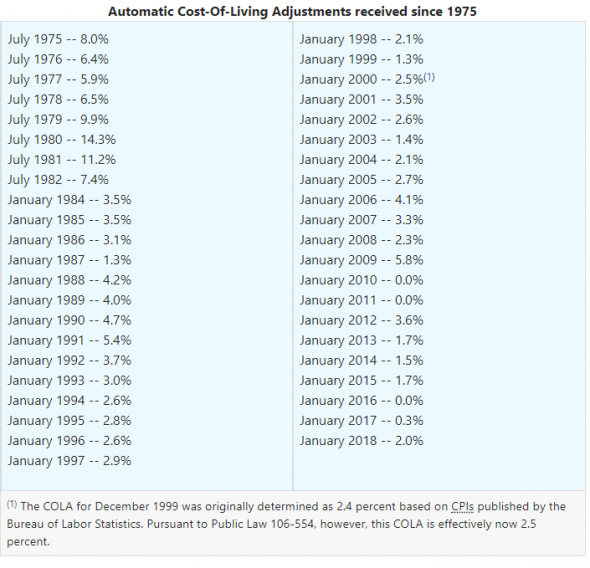

The purpose of the COLA is to ensure that the purchasing power of Social Security and Supplemental Security Income (SSI) benefits is not eroded by inflation. It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) from the third quarter of the last year a COLA was determined to the third quarter of the current year. If there is no increase, there can be no COLA.

“Today’s 2 percent COLA announcement gives some relief to Social Security beneficiaries and their families who depend on their earned, modest benefits,” AARP CEO Jo Ann Jenkins said in a statement. “Since 2011, beneficiaries have received little to no increase – never more than 1.7 percent. For the tens of millions of families who depend on Social Security for all or most of their retirement income, this cost of living increase may not adequately cover expenses that rise faster than inflation including prescription drug, utility and housing costs.”

Other minimums and maximums were also raised.

The maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $128,700.

The earnings limit for workers who are younger than “full” retirement age (age 66 for people born in 1943 through 1954) will increase to $17,040. (We deduct $1 from benefits for each $2 earned over $17,040.)

The earnings limit for people turning 66 in 2018 will increase to $45,360. (We deduct $1 from benefits for each $3 earned over $45,360 until the month the worker turns age 66.)

There is no limit on earnings for workers who are “full” retirement age or older for the entire year.

Well, the $25 will help with the $92 dollars jump in our D supplemental medicare last year.