The Department of the Treasury

-

White House Watch

Biden’s Treasury Department Creates ‘Racial Equity’ Task Force To Look For Racism In The Economy

The Treasury Department announced the formation of the Treasury Advisory Committee on Racial Equity (TACRE) Tuesday morning, serving to advise…

Read More » -

In Congress

Treasury to Reallocate Rental Assistance Money Based on State Demand

The Treasury Department announced plans to redistribute rental assistance funds from states and localities that have not exhausted their money…

Read More » -

White House Watch

Treasury Department Hires First-Ever ‘Counselor For Racial Equity’

The Treasury Department announced Monday it hired its first every Counselor for Racial Equity to support President Biden’s push for…

Read More » -

Biden Administration Proposes ‘More Realistic’ 15% Global Corporate Tax Rate

The Biden administration proposed a minimum global corporate tax rate of 15%, but said it hoped world leaders would negotiate…

Read More » -

Syndicated Posts

Treasury Works with Government of Mexico Against Perpetrators of Corruption and their Networks

OFAC Sanctions a Magistrate Judge and Former Governor, Among Others Washington – Today, the U.S. Department of the Treasury’s Office…

Read More » -

Treasury Removes Sanctions Imposed on Former High-Ranking Venezuelan Intelligence Official After Public Break with Maduro

Washington – Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) removed sanctions imposed on Manuel Ricardo…

Read More » -

Treasury Targets Sanctions Evasion Conduits for Major Hizballah Financiers

Washington – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) further targeted the global business…

Read More » -

White House Watch

Trump Administration Takes Action to End Cuba’s Malign Influence on Venezuela

Today, the United States sanctioned four companies for operating in the oil sector of the Venezuelan economy and identified nine…

Read More » -

Money & The Economy

Financial Action Task Force (FATF) Ministers Take Steps to Protect the Global Financial System

Washington – Today, U.S. Department of the Treasury Secretary, Steven T. Mnuchin, chaired a meeting of Ministers and other senior…

Read More » -

Money & The Economy

Terrorist Financing Targeting Center Hosts Exercise on Disrupting Illicit Finance

Riyadh, Saudi Arabia – The Terrorist Financing Targeting Center (TFTC) this week convened a regional capacity-building workshop in Riyadh focused…

Read More » -

Money & The Economy

Treasury Offers Underpayment Penalty Relief to More Taxpayers

Washington – Today, the U.S. Department of the Treasury lowered the withholding underpayment threshold to 80 percent, delivering more taxpayers…

Read More » -

Money & The Economy

Treasury Sanctions Venezuela’s National Development Bank, and Subsidiaries, in Response to Illegal Arrest of Guaido Aide

Washington – Today, the Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated Banco de Desarrollo Economico y…

Read More » -

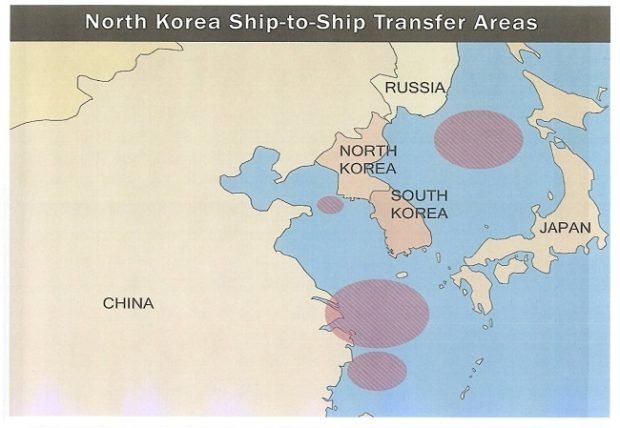

Syndicated Posts

Treasury Designates Two More Shipping Companies for Attempted Evasion of North Korea Sanctions

WASHINGTON – The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) today announced the designation of two…

Read More » -

Money & The Economy

Treasury Sanctions Venezuela’s Gold Mining Company and Chief for Propping Up Illegitimate Maduro Regime

Washington – Today, the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) designated CVG Compania General de…

Read More » -

Syndicated Posts

U.S. Government Fully Re-Imposes Sanctions on the Iranian Regime

WASHINGTON – Today, in its largest ever single-day action targeting the Iranian regime, the U.S. Department of the Treasury’s Office…

Read More »