Biden Has Mastered The Art Of Cutting American Wages

Call him the wage cutter. Under President Joe Biden and congressional Democrats’ watch, today’s latest jobs report shows Americans are still suffering painful pay cuts due to the ravages of inflation.

This could certainly harm Democrats’ election prospects, with polls like Gallup, along with Monmouth University and Pew Research showing inflation and the economy is the top issue among voters.

Today the Bureau of Labor Statistics reported that over the past 12 months, average hourly earnings increased by 5.0%. We’ll get September’s inflation numbers next Thursday, but based on August’s report showing annual inflation of 8.3%, Americans are still suffering a significant pay cut of 3.3% in the past year.

In September, average hourly earnings for all employees on private nonfarm payrolls rose by a measly 10 cents, or 0.3 percent, to $32.46. A ten cents pay raise is a pittance for most Americans, though the White House certainly is tone deaf to this, last getting rightfully hammered for crowing about the average American saving 16 cents for a July 4th BBQ cookout.

This lack of common sense, lack of understanding the average person’s suffering is a common Biden administration thread, with White House Chief of Staff Ronald Klain retweeting and cheering on a Twitter post calling the inflationary supply-chain crisis “high class problems.”

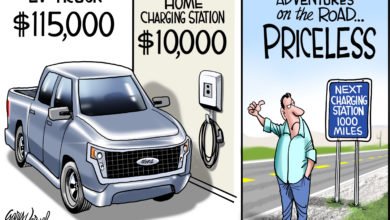

Klain’s ignorance could come back to haunt him, with The Heritage Foundation showing the average American has lost the equivalent of $4,200 in annual income under the Biden administration due to the ravages of record-high inflation and higher interest rates.

Heritage noted that consumer prices have risen 12.7% since January 2021, far faster than wages, which translates to the average American worker losing $3,000 in annual purchasing power.

Add this $3,000 to the impact of the Federal Reserve implementing tighter monetary policy to reduce inflation and rising interest rates. This triggers higher rates, spiking borrowing costs on mortgages, vehicle loans, credit cards and more.

Heritage’s E.J. Antoni estimates the higher interest rates and borrowing costs “have effectively reduced the average American’s purchasing power another $1,200 on an annualized basis.”

On top of this inflation pay cut, America’s retirement plans, 401ks and other stock market investments have taken a severe beating, losing trillions of dollars. This comes in the first three consecutive quarters of losses for the first time since the 2008 financial crisis.

They say the definition of insanity is to keep doing the same thing over again and expect a different result.

Carrie Sheffield is a senior policy analyst at Independent Women’s Voice.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

Agree/Disagree with the author(s)? Let them know in the comments below and be heard by 10’s of thousands of CDN readers each day!

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org.