retirement

-

Money & The Economy

There’s An Overlooked Way Biden’s Economy Is Taking An Axe To Americans’ Retirement Accounts

Government pensions that invested in commercial real estate are being hit hard by the ongoing crisis in the sector, which…

Read More » -

Money & The Economy

House Swiftly Passes Key Tax Benefits For Retirement Accounts. Here’s How It Works

The House of Representatives passed a bipartisan bill Monday providing massive tax benefits for American workers’ retirement savings accounts. The…

Read More » -

Money & The Economy

Nearly 7 In 10 Retirees Say They Live As Well Or Better In Retirement Than During Their Working Years

More than two-thirds of retirees say they live as well or better in retirement as they did when they were…

Read More » -

In The News

Watch Live: President Trump Participates in a Signing Event on Strengthening Retirement Security in America

President Donald Trump signs an executive order that strengthens retirement security for Americans on Friday afternoon in Charlotte, North Carolina.…

Read More » -

Money & The Economy

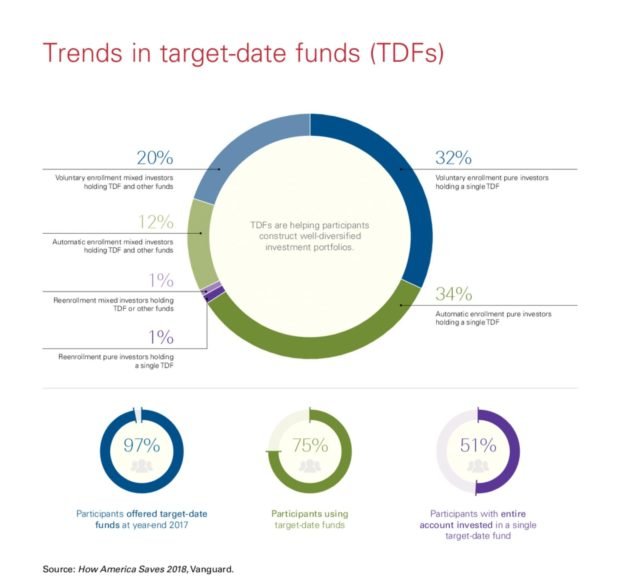

More Than Half Of 401(k) Participants Invest In A Single Target-Date Fund

Vanguard reports that more than half of 401(k) participants are now invested in a single target-date fund (TDF), compared to…

Read More » -

Money & The Economy

Gig Economy May Replace Retirement for Many

Today, more than one in three U.S. workers are freelancers — and this figure is expected to grow to 40 percent…

Read More » -

In The News

The Stock Market: Three Days Post Election

FRIDAY 10:30 AM. The graph is obvious. Three days after the reelection of Barack Obama the stock market is still…

Read More » -

Retirement Planning at 40-Something – Halftime of the Big Game

LUBBOCK, Texas, Sept. 11, 2012 — If you started retirement planning early in your career, it’s good news by the…

Read More » -

Feds Targeted for $600M in Improper Retirement Payments

“Feds Targeted for $600M in Improper Retirement Payments” An Extremely Deceiving Headline By Dell Hill When Fox News first reported…

Read More » -

New Mobile Technology Transforms How America’s Workers Save for Retirement

Innovative Financial Advisors pilot cutting-edge process resulting in dramatic improvements in retirement savings SANTA ROSA, Calif., Aug. 31, 2011 —…

Read More » -

Darning The National Fabric

Our country is stumbling blindly down an unsustainable path. While much is being made about the National Debt and how…

Read More »