student loans

-

In The News

Here’s How Much Biden’s Newest Student Loan Giveaway Would Cost Taxpayers

President Joe Biden’s new student loan forgiveness plan would cost tens of billions to implement on top of hundreds of…

Read More » -

White House Watch

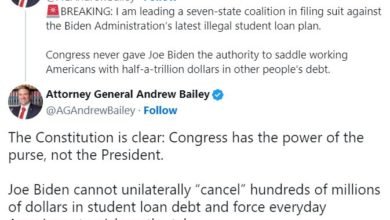

Finally: Red State AGs Sue Biden Admin Over New Student Loan Bailout

Seven Republican attorneys general filed a lawsuit Tuesday against President Joe Biden’s administration over a new student loan forgiveness plan…

Read More » -

White House Watch

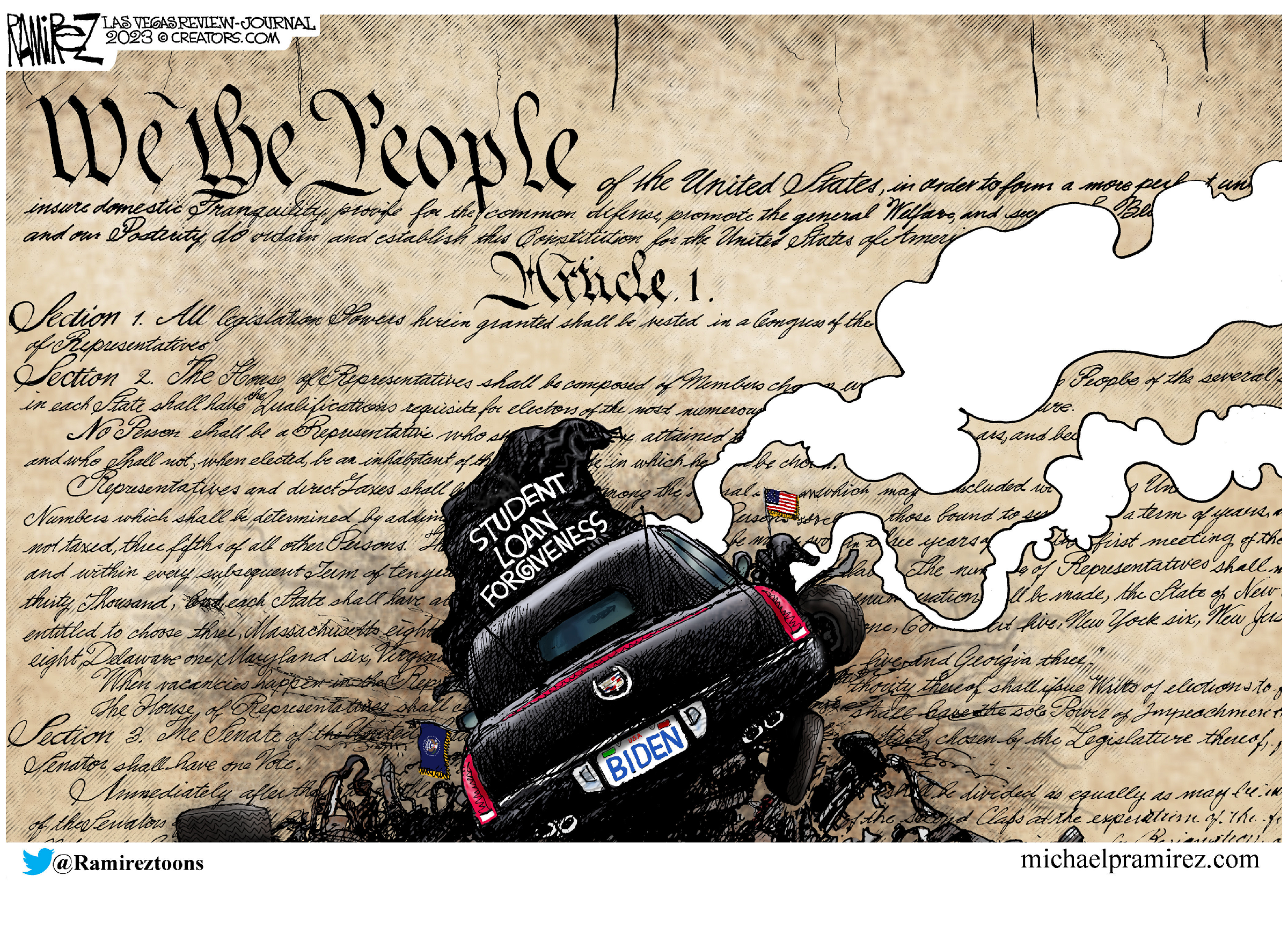

Fox Legal Analyst Alleges Biden’s Student Debt Actions Are ‘Shredding The Constitution’

Fox News legal analyst Gregg Jarrett on Monday criticized President Joe Biden for his actions to forgive student debt in…

Read More » -

White House Watch

Biden Admin Announces Latest Batch Of Student Loan Cancellations

President Joe Biden announced Thursday that he was canceling nearly $6 billion in student loan debt for public service workers.…

Read More » -

White House Watch

Biden Seeks To Expand Student Debt Handout In New Budget

President Joe Biden hopes to expand his efforts to slash student debt with a $12 billion initiative in his fiscal…

Read More » -

White House Watch

‘Irresponsible’: Biden’s Latest Student Loan Bailout to Cost Taxpayers Half A Trillion Dollars

The Biden administration’s latest student loan forgiveness plan is estimated to cost taxpayers at much as half a trillion dollars,…

Read More » -

White House Watch

Biden Admin’s New Student Loan Plan Will Involve Zero-Dollar Payments For Millions, No Penalties For A Year

The Biden administration is planning to use a generous income-driven repayment plan as its main method of easing student loan…

Read More » -

White House Watch

DUH: Biden’s Student Loan Pause Benefited Richest Borrowers

The long-lasting extension of student loan repayment freeze is benefiting wealthier borrowers, according to University of Virginia economics and education…

Read More » -

White House Watch

‘Temporary Band Aid’: Biden’s Student Loan Plans Could Drive The US Toward Recession, Fiscal Watchdog Argues

Biden’s plan to cancel student loans and cut monthly repayments could drive the country towards a deeper recession, a federal…

Read More » -

In The News

Republican Lawmakers Unveil New Plan To Spike Biden’s Student Loan Bailout

Several Republican lawmakers announced on Friday that they will introduce a Congressional Review Act (CRA) to reverse President Joe Biden’s…

Read More » -

In Education

Biden Admin Is Placing Undercover Federal Agents At Universities. Here’s Why

The Enforcement Office of Federal Student Aid (FSA) will use undercover officials to monitor colleges and universities for misleading or…

Read More » -

White House Watch

Bank Sues Biden Admin Over Latest Student Loan Payment Freeze

SoFi, a private finance company and bank, sued President Joe Biden’s administration on Friday over its latest pause on student…

Read More » -

In the Courts

‘I Was Pleased’: Republican Attorneys General Optimistic SCOTUS Will Rule In Their Favor In Student Loan Case

The Supreme Court heard oral arguments for two cases challenging the Biden administration’s student loan cancellation plan on Tuesday, and…

Read More » -

In Education

Biden’s Student Loan Forgiveness Plan Hurts ‘Colleges Like Mine,’ College President Says

A Christian college president called out President Joe Biden’s student loan forgiveness plan for hurting colleges that do not take…

Read More » -

White House Watch

Millions Of Student Loan Borrowers Got Emails Mistakenly Saying Their Forgiveness Applications Were Approved

The Department of Education’s (DOE) Federal Student Aid program emailed about 9 million student loan forgiveness applicants Tuesday to tell…

Read More »