The Fed Should Take Action at Jackson Hole to Reduce Inflation

This week, the Federal Reserve (Fed) will meet for its annual symposium at Jackson Hole, Wyoming. This symposium is sponsored by the Federal Reserve Bank of Kansas City, which has held this event since 1978. The Fed usually doesn’t set or change any policy during this time, but rather it focuses on general economic issues facing the U.S. and world economies.

This year it should move to set or change current policy. The Fed’s Open Market Committee will meet again for its regularly scheduled meeting next month, but each month that action is delayed means that the action must be stronger when finally taken. Frankly, Fed action was due much earlier this year.

What action should the Fed take?

Inflation since January has been a problem for the U.S. economy. Since January, consumer prices, as measured by the Consumer Price Index (CPI), have increased by more than 4%. If this rate continues, inflation for all of 2021 will be more than 7%. This greatly exceeds the Fed’s target, which is usually between 2% and 3%.

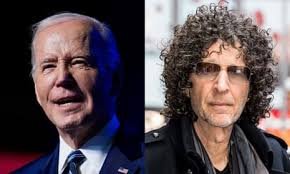

While the Fed, as well as the Biden administration, continues to say that the inflation problem is transitory (temporary), an objective view of the data leads to a much different conclusion. The Fed says it is supply chain disruptions caused by COVID-19-related shutdowns and severe winter weather that has caused the inflation. It claims that inflation will disappear once those disruptions are corrected.

The problem with that explanation is that almost all of the supply chain disruptions have been resolved, yet prices continue to rise. In July, the GDP level was about where it was prior to the shutdowns in March of 2020. Yet prices continue to rise. In fact, prices at the producer level rose 1% in the month of July. That’s more than a 12% annual inflation rate.

If producer prices rise, a month or two later consumer prices will have to rise so that business can maintain profit margins. That means the inflation problem is likely to get worse in the near future, not better.

That producer inflation number for July should have been in the 0.1% to 0.2% range if it was supply chain disruptions that caused the inflation. The high number for producer prices indicates there are other causes, other than supply chain disruptions, for the inflation problem. Most of those causes are due to excess demand in the economy.

The excess demand results from government policy. The Fed continues to vastly increase the money supply by buying $120 billion of government bonds per month. This has resulted in the money supply increasing by about 20% in the last 12 months. That’s clearly too many dollars chasing too few goods.

The Fed has also kept interest rates near zero. That results in mortgage loans at less than 3% and car loans near zero. Consumers who may not have considered buying a house or a car now decide to enter the market to take advantage of the low rates. That’s mostly why car and house prices are rising so rapidly.

In 2020 and 2021, the federal government spent $6 trillion more than it received in tax revenue. That’s mostly excess demand. In addition, some of that spending was used to give free money to all income-earning Americans. The average family of four received more than $11,000 in free money from the government in the last year or so.

That’s pure excess demand.

In addition, the Biden administration has declared war on fossil fuels by canceling the Keystone XL pipeline, prohibiting drilling on federal land, and prohibiting energy extraction off the coast of Alaska. This restriction of energy supplies pushed up energy prices.

And lastly, for a number of reasons — one of which is generous unemployment benefits supplemented by government policy — lower income workers are not returning to work. This has caused a wage inflation problem for business. This increased cost will result in higher future consumer prices.

The Fed must begin immediately and gradually to reduce its bond-buying program. It must also immediately and gradually raise interest rates, similar to its action from the end of 2016 to the end of 2018. During that period interest rates were increased eight times.

It is likely the Fed will not take action at Jackson Hole. But there will be pressure to act at its September meeting on September 21-22. By then the inflation numbers for August and September will be available. They will likely show inflation running at least in the 6% annual range and maybe higher.

In September the Fed will be forced to act. Waiting until September means that gradual actions may not be enough.