Major Economic Indicator Drops Further, Suggests a Recession

A major indicator of U.S. economic activity decreased by 0.4 percent in July 2022 to 116.6 (2016=100), after declining by 0.7 percent in June. The Leading Economic Index (LEI) produced by The Conference Board was down by 1.6 percent over the six-month period from January to July 2022, a reversal from its 1.6 percent growth over the previous six months.

“The US LEI declined for a fifth consecutive month in July, suggesting recession risks are rising in the near term,” said Ataman Ozyildirim, Senior Director, Economics, The Conference Board. “Consumer pessimism and equity market volatility as well as slowing labor markets, housing construction, and manufacturing new orders suggest that economic weakness will intensify and spread more broadly throughout the US economy. The Conference Board projects the US economy will not expand in the third quarter and could tip into a short but mild recession by the end of the year or early 2023.”

The LEI is a leading indicator, an index that suggests future growth or retraction in the U.S. economy.

The economy showed other signs of weakness in July, particularly in the housing sector. Home sales fell about 20% from the same period a year ago and were down 6% from June.

“In terms of economic impact we are surely in a housing recession because builders are not building,” said Lawrence Yun, chief economist for the Realtors.

The downturn in housing sales comes after the Federal Reserve began raising rates by as much as .75% at each meeting and they don’t plan to stop those increases any time soon.

“I would lean toward the 75 basis points at this point. Again, I think we’ve got relatively good reads on the economy, and we’ve got very high inflation, so I think it would make sense to continue to get the policy rate higher and into restrictive territory,” Federal Reserve Bank of St. Louis President James Bullard said Thursday. “We’ve got a long way to go to get inflation under control.”

Meanwhile, the Biden administration is continuing to solve problems Americans don’t have:

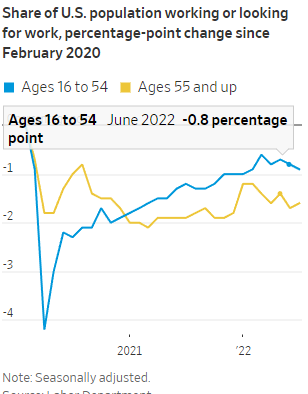

A key part of the equation has been moving in the wrong direction: The supply of workers has been shrinking. The labor force is about 600,000 smaller than in early 2020, when Covid-19 triggered a deep but short recession. It is several million smaller if you adjust for the increase in population. After approaching prepandemic levels earlier this year, the number of workers has fallen since March by 400,000, according to Labor Department data.

https://www.wsj.com/articles/labor-shortage-is-vexing-challenge-for-u-s-economy-11660469401

Since March of 2022, the number of workers in all age groups has fallen meaning that regardless of age, fewer people are available to or desire to take a job. This is the source of the unemployment rate matching “the lowest it’s been in half a century,” as Harris stated.

Touting job creation in the current economy is unwarranted. As of July, there were 10.7 million unfilled job openings in the U.S. which is near historic highs.

Content created by Conservative Daily News and some content syndicated through CDN is available for re-publication without charge under the Creative Commons license. Visit our syndication page for details and requirements.