What Is “Coverage”?

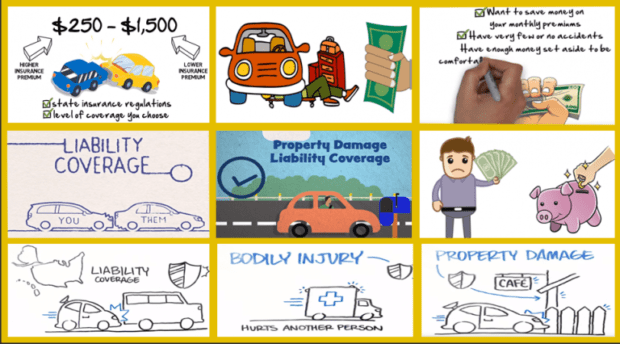

The word ‘Coverage(s)’ is just insurance speak for the different types of insurance products you can purchase. The seven most common ones are: Collision Coverage, Comprehensive Coverage, Property Damage, Bodily Injury, Medical Payments (also called Personal Injury Protection) and Rental.

These are coverages that will assist with medical bills, repair your vehicle, take care of any property that you have damaged and any injuries from an accident.

Now, keep in mind, these are the most basic coverages you can buy. Each insurance company has more coverages than those listed above. I’m sure you’ve seen commercials for some of these different options, for example, they have commercials that talk about replacing your car with a new one or not raising your rates after an accident. Each of those things are considered different or extra coverages and every one of those are something you add to your insurance policy and pay extra for. They are not included in the standard coverages.

Collision Coverage

It’s the main coverage that takes care of your car. Collision coverage covers any damages done in an accident to your vehicle. This will cover things like hitting or being hit by another car, striking debris (like boxes) in the roadway or when you run into a building.

Collision coverage, under most policies, will also pay for any tow relating to an accident and storage fees.

Storage fees are the daily amount a tow yard charges for your vehicle to sit there. If your vehicle is towed to a tow yard after an accident, the insurance should cover these fees, as long as they’re reasonable. If you leave your vehicle sitting at a tow yard for a month before you notify your insurance company about the accident, they probably will not pay for the full amount of the storage fees.

The reason for this is every insurance policy, at least the ones I’ve seen, have a clause that says you have a duty to mitigate damages. A commitment to mitigate simply means that you will not delay the notification or repair of your vehicle and will work with the insurance company to resolve your claim in a timely manner. So, to a normal person, letting your truck sit in a tow yard for a month before deciding to file your complaint, is not reasonable and is not timely.

When You Buy Collision Coverage, You Will Have to Choose a Deductible

This is the amount you will have to pay out of pocket for repairs on your car EVERY time you use the coverage. It is not like health insurance, where you only have to pay up to a certain amount in a one-year period. This applies every time you use the coverage; translation: every time you have an accident you will pay a deductible under your collision coverage.

Your friends, family and you are probably thinking, the deductible won’t apply if I’m not at fault- you are wrong. Every state has their requirements, but generally, there are only a few instances where your deductible will not apply.

Remember the list below is not a full list and may vary slightly by state regulations. Also, some insurance companies will not waive your deductible for any reason, unless they are required to by state regulations.

They are:

- The insurance companies of the orders drivers accept the responsibility. Then your insurance company may be able to waive your deductible.

- You have purchased coverage for a deductible that gets reduced every year you don’t have an accident.

- You have purchased an individual coverage with your insurance company to waive your deductible automatically.

Otherwise, if you are using your collision coverage, you will be responsible for your deductible.

Collision coverage and comprehensive coverage, which is discussed in the next chapter, are optional when you buy insurance. However, if you have a car loan, it is probably required by your lienholder to have both of these coverages. If you do not have these coverages, your insurance cannot and will not repair your vehicle if you have an accident. You will have to hope that you are not at fault and that the other person has valid insurance.

Comprehensive Coverage

Comprehensive coverage covers damages to your vehicle for all non-collision accidents. Which means, it’ll cover your car if a tree falls on it, it gets flooded, catches on fire, it gets stolen, or you hit an animal. There are other instances this coverage will cover your vehicle, but they are a bit rarer and very claim specific and not every company allows them. So, make sure to just give it a quick read when you buy your policy, I mean if Big Footsteps on your car, you got to know that your policy covers it.

Comprehensive Coverage Also Has A Deductible

However, unlike collision coverage, this deductible is almost NEVER waived. You will owe this every time you use the coverage. So, choose your deductible wisely. You need to think, if I hit a deer tomorrow, what would I have in my budget to get it fixed. Now, remember insurance is expensive, so you have to also balance that out with what you can afford to pay for monthly coverage.

Rental does exactly what it sounds like; it is the coverage that will pay for a rental vehicle while your vehicle is being repaired after an accident. This is NOT part of your collision or comprehensive coverages. It is a separate coverage and costs a little extra.

When deciding if you need this coverage, ask yourself, if my car is in the repair shop for 2-3 weeks, what will I drive? If the answer is I won’t have a car and won’t be able to get back and forth to work, then I’d suggest looking into rental coverage.

Rental Only Covers Putting You into A Rental

If you are at fault in an accident, your insurance company provides a rental vehicle to the other driver under Property Damage, which is discussed later on.

Rental coverage only covers a certain amount per day. Every company has different daily rates and will give you options regarding which rate you would like. There are some things to know about this coverage when you go to the rental car location to pick up your vehicle.

- The insurance will only cover the amount per day on your policy. If you chose a policy of $30.00 per day, this will usually cover a small 4-door sedan. So, if you get into a sporty convertible or SUV, you are going to be paying extra.

- The rental company will likely try to sell you extra items, such as pre-purchasing fuel or extra insurance through the rental car company. These are items that are not needed; your insurance will cover the rental just like it is your car. Since these fees are extra, they are NOT owned by the insurance company. You will be stuck paying these out of pocket if you decide to take them.