How to Apply for a Balance Transfer Credit Card

Trying to find out how to apply for a balance transfer credit card is more than just taking the necessary steps to get out of a credit card debt: it is a matter of being smarter with your money. We talked to experts in the industry who teach others how to make smarter decisions – and a balance transfer credit card, is pretty high on the list of recommendations.

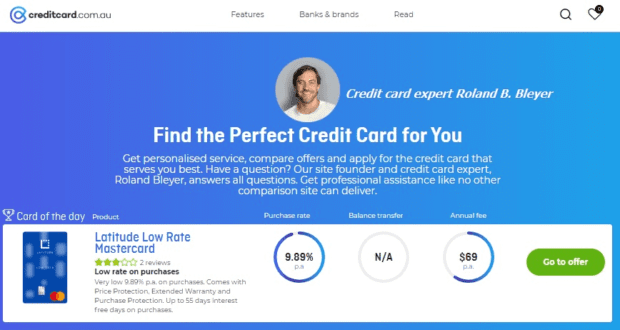

As Roland B. Bleyer, founder of CreditCard.com.au said recently in the news: “The smart consumer now re-evaluates their options periodically to ensure they have an advantageous deal from the most competitive card providers.”

Balance transfer credit cards allow you to move your debt to another card with a zero or lower interest rate. However, these cards usually have an introductory period for the zero-interest rate. You have to pay off the balance before the period ends, or you risk getting charged a higher rate.

The period can be about 6 to 24 months, depending on your balance amount and the terms of the new provider.

If you think getting a balance transfer card is ideal for you, here is what you need to do.

Check Your Current Rate

It’s advisable to determine your current rate to know what you should opt for when shopping around.

Regular credit cards usually have an interest rate of about 15 percent to 22 percent. Let’s say your current rate is 18 percent p.a., and your balance is $5,000. If you are making about 394 monthly payments for 15 months, your interest payments will be about $900.

So, if a balance transfer card can help you avoid the interest payments entirely or cut the overall amount significantly, then go for it.

Know the Eligibility Requirements

Before you get approval, there are several requirements you must meet. You must be at least 18 years old and an Australian citizen or permanent resident.

You’ll need to provide proof of identity, and this can be a driver’s license, an Australian passport, or a Medicare card. Your financial details, such as current bank account balance, income, and debts, are also essential.

Keep in mind that the balance transfer offer may also have other specific requirements. For example, you can qualify for the card itself, but your balance isn’t within the minimum and maximum transfer amounts. This means you’re unlikely to benefit from the card.

Some banks may require you to be a new customer when you apply for the card. They can offer compelling rates to entice you.

Compare Your Options

Before making the switch, you should be able to know how one BT card stacks up against other options.

Compare the rates offered by several cards; it’s even better is you get one with 0-percent interest. Does the card charge an annual fee? If so, what’s the amount, and how high or low is it compared to other options?

You should know the length of the introductory period and the balance transfer fees. Comparing these factors should make it easy to pick the right card.

Submit Your Application

Most lenders allow you to apply for a card online in about 10 minutes or less. Take the time to understand the application details and provide all the required information. Make sure the information is correct and up-to-date.

It’s at this point that you’ll also submit the details of your current credit card. You can choose to transfer all the amount or a part of it, depending on your goal.

Some lenders will need to review your bank statements for the past six months. You may be required to give consent to identity verification through third-party sources, such as data aggregators, government agencies, or financial institutions.

You’ll also need to allow them to perform a credit check.

You can then submit your application once you’re confident about the details you’ve provided. Most lenders will respond within 24 to 48 hours. Once you’re approved, you should get the card within 5 to 10 business days via mail.

Close Your Old Card

If you chose to transfer the whole balance to the new card, it’s important to remember to close your old credit card account. Leaving it open can easily tempt you to start using the card again, only to continue piling up your debts.

Closing it will also help you avoid paying annual fees for a card you’re no longer using.

Final Thoughts

Once you receive the card, be sure to come up with a repayment plan that will allow you to pay the balance before the introductory period ends.

You can start by limiting your spending to save more for repayments. Also, keep in mind that using the card for any purchases while you have an outstanding balance will attract a high-interest rate. You should pay off the balance before you start using the card normally.

To ensure you’re always making timely payments, you can automate credit card repayments to save you time.