The Coming Social Security War

When one faction of politicians makes a principled stance and threatens to shut down the government, the opposing faction likes to conjure up images of an apocalyptic world where the sick and the elderly are left to starve because they cannot get their federal benefits. As it turns out, the real threat to entitlements is a fully functioning government doing its job, which is to say voting to continuethe bloated stasis of bureaucratic mismanagement.

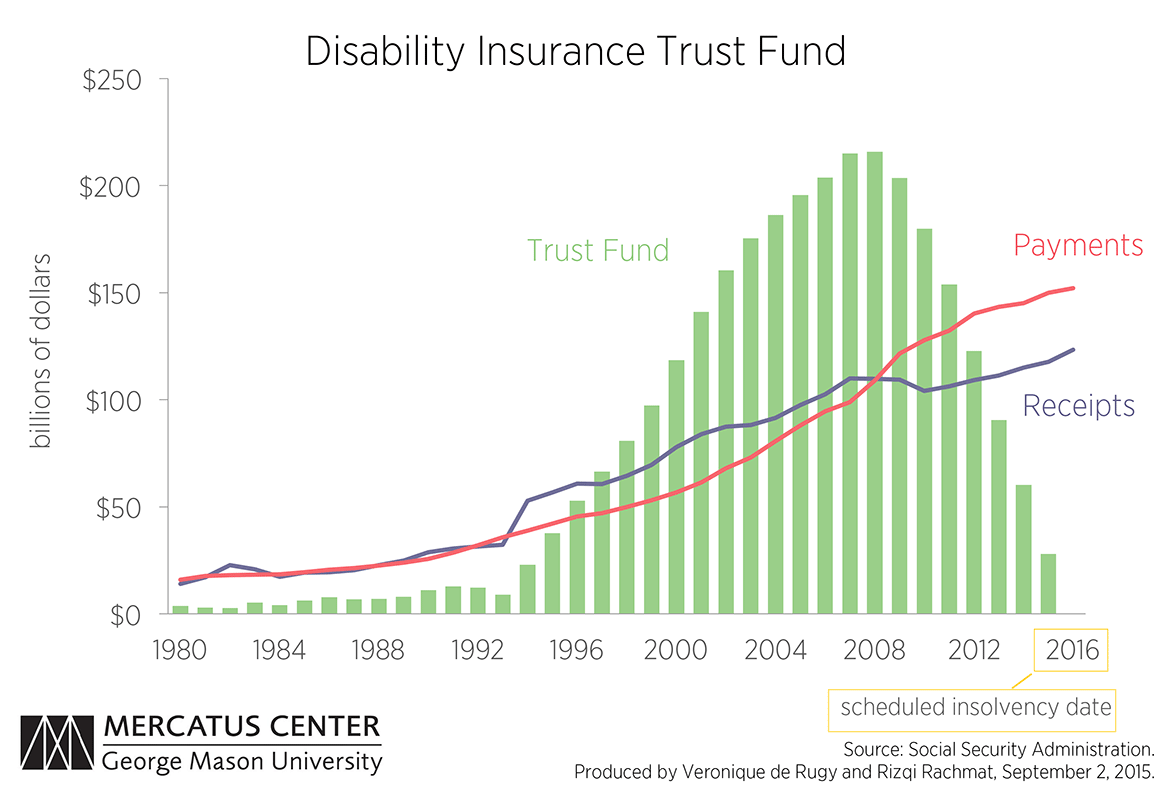

Social Security’s Disability Insurance Trust Fund, which has been underwater since approximately 2008, will be completely broke in 2016. (And the Old-Age and Survivors Insurance Trust Fund is projected to be bankrupt in 2034.)

Since the legislative battle will occur with a national election in the background, it’s a pretty safe bet that Congress will be paralyzed by fear of alienating some supposedly key corps of the voting demographic.

But even if this weren’t the case, no innovative solutions have yet been offered up for the long-prophesied bankruptcy of Social Security. The most popular- and politically correct- solution is eliminating the cap on earnings, which currently sits at $118,500, and raising payroll taxes.

This Robin Hood-esque solution of taxing the “rich” multitudes to save the poor and disenfranchised is not only morally repugnant, it’s also not feasible.

Approximately 83% of income falls under the cap. Even assuming that the so-called super rich complied completely with a tax hike, the payroll tax would need to be raised by almost 4.4% in order for the program to be able to meet its projected obligations.

But this alone is not enough. Social Security outlays will exceed revenue by 30% in 2025 and 40% and 2040. According to the Congressional Budget Office‘s projections, for Social Security to break even by 2089, “actuarial balance could be achieved for Social Security through calendar year 2089 if payroll taxes were increased immediately and permanently by 4.4 percent of taxable payroll, if scheduled benefits were reduced by an equivalent amount, or if some combination of tax increases and spending reductions of equal present value was adopted.”

While it may be popular to talk about eliminating the cap so high-income earners assume a larger share of the financial burden, it certainly is not to propose doing so on the middle class. And neither party is going to be the one to enthusiastically suggest cutting benefits that have come to be viewed as an entitlement.

Yet, something drastic must be done, especially since Social Security spending currently stands at 4.9% of GDP and is projected to grow to 6.2% by 2040.

The Congressional record is rife with such exigent crises, to which the political response of popularity conscious public servants was to kick the can down the road, continuing to place the future wellbeing of their constituents in limbo.

There’s no reason to believe this will end differently than with a “grand political bargain” that raises the cap and slightly ups the tax, to be touted by glad-handing politicians invested in cultivating a centrist, consensus narrative.

But it will do nothing other than prolong a problem that is pernicious as it hampers economic freedom, especially for the young and ambitious for whom even a small percent of lost income can be a roadblock to success.

Social Security is NOT an entitlement! It involves money that I was forced to contribute during the course of my working life; money that needs to be returned to me on a monthly basis…

OK, enjoy your, what, $250.00 per month

HEY vrw, I to have paid for 48 years. I want my damn money. I am also now disabled from WORK injurys I WANT MY MONEY. GET ALL THE FREELOADERS OFF THE PAYROLL! STOP the hand outs! Bet you have never WORKED a day in you life.