Do Big Wind Project Cancellations Signal Peak Subsidy Has Been Reached?

The last few months have seen a parade of troubling news related to the health of the offshore wind sector, as rising inflation, mucked-up supply chains, and high interest rates have rendered big projects planned for the U.S., UK, and German offshore regions uneconomic. The remedy sought by big players in the industry like Siemens, Orsted, BP and Equinor has been to seek higher subsidies from local, regional, and national governments whose renewable goals drive the rationale for the industry’s very existence, and whose largesse sustains its business model.

More and more often, though, the answer back from those governments has transitioned from the easy ‘yes’ of the past to an increasingly frequent and unambiguous ‘no.’ In September, for example, big Danish wind developer Orsted requested more subsidies from the state government of New York in the form of a big OREC adjustment related to its Sunrise Wind project and was denied in a decision upheld by the state’s courts in October. For those unfamiliar with the industry’s acronyms, the term “OREC adjustment” refers to Offshore Wind Renewable Energy Certificates, a classic environmental rubric in which local, state or the federal government pays wind developers an agreed-upon fee for each megawatt of power they build in locations favored by those governments. Those fees end up being worked into the utility rates paid by electricity consumers as one of an array of hidden charges on their monthly bills.

That denial of more subsidies for Big Wind turned out to be a harbinger of things to come. Orsted dealt a major blow to the offshore wind aspirations of the Biden government and Democratic policymakers in several northeastern states this week by announcing the cancellation of its Ocean Wind 1 and Ocean Wind 2 projects planned for construction off the coast of New Jersey. In its earnings release, Orsted said it was recognizing impairment losses of DKK 28.4 billion, which equates to roughly $4 billion USD, blaming “adverse impacts relating to supply chain delays, increased interest rates, and the lack of an OREC adjustment on Sunrise Wind” for the need to take the write-down.

The company’s financial struggles were no real secret, especially since it has engaged in a strategy of using “farmdowns,” i.e., selling off interests in its existing projects to raise cash to offset losses in recent months.

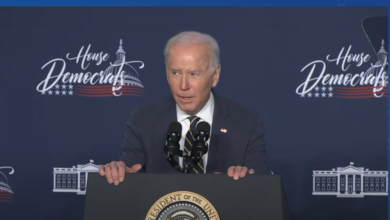

The announcement by Orsted is obviously a big setback for the arbitrary and unneeded offshore wind goals of the Biden administration, and for New Jersey Gov. Phil Murphy (D) and his desires for the state’s grid to be 100% powered by renewables by 2035. The rising controversies over offshore wind and its alleged destructive impacts to endangered whales, the environment, and home utility bills are also a big problem for New Jersey Democrats as they try to hold onto majorities in the legislature in the Nov. 7 elections.

Murphy made his displeasure with Orsted’s decision clear, saying, “Today’s decision by Orsted to abandon its commitments to New Jersey is outrageous and calls into question the company’s credibility and competence. As recently as several weeks ago, the company made public statements regarding the viability and progress of the Ocean Wind I project.”

Orsted isn’t the only U.S. wind developer taking write-downs. Reuters reports that two Big Oil companies who’ve invested in Biden’s offshore wind program – UK giant BP and Norway’s Equinor – took impairment losses of $540 million and $300 million, respectively, in recent days. That amounts to fairly small potatoes for those companies, whose oil and gas operations are hugely profitable in today’s high commodity price environment.

But pure wind developers like Orsted do not enjoy the luxury of being able to offset losses from major offshore wind projects with profits from a more robust core business segment. The industry’s go-to strategy up until now has been to simply appeal to friendly politicians to invoke higher subsidies to enable their projects to continue moving ahead. But now it seems that even some blue states in the U.S. have reached the point of being unwilling to throw more good money after non-profitable ventures.

For the offshore wind industry, if Peak Subsidy really is on the horizon long before anyone expected, the question now becomes, what next?

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org

Agree/Disagree with the author(s)? Let them know in the comments below and be heard by 10’s of thousands of CDN readers each day!

Murphy has been living in a fantasy world of his own making the whole time he’s been “in office”. What next, indeed?