A Massive Carveout In Dems’ Climate Law Is Boosting Foreign-Made EVs

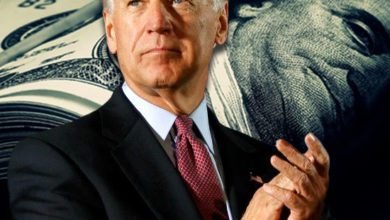

A key carveout in President Joe Biden’s signature climate bill is allowing companies to take advantage of federal tax credits to lease foreign-made electric vehicles (EVs).

The Inflation Reduction Act (IRA) features a $7,500 tax credit to incentivize Americans to purchase EVs that meet certain “made in America” sourcing and manufacturing standards, but the tax credit is still available to some foreign-made EVs if they are leased rather than sold. EV leases appear to have become more popular in recent months as dealers try to move growing backlogs of EVs off their lots, as consumer demand has cooled off and manufacturers have cut prices.

“Anecdotal information is that leases are going up, in some cases dramatically, due to the applicability of federal tax credits to commercial tax credits,” Brian Maas, president of the California New Car Dealers Association, told the Daily Caller News Foundation. “We have heard reports that, for some brands, leasing is exceeding 50% of all EVs sold by the dealer, especially for brands that cannot qualify with the domestic content and manufacturing requirements.”

The dynamic could complicate the White House’s goal to have 50% of all new car sales be EVs by 2030, a target which it has already spent billions and regulated aggressively to reach.

The Biden administration announced that leased EVs not assembled in North America were eligible for the tax credit in December 2022; between then and July 2023, the share of retail EV sales that were lease sales jumped by almost 15%, according to Cox Automotive. Given the shorter-term and temporary nature of leasing an EV compared to buying one, leasing may be the better deal for consumers who want to access the value of federal tax credits while also hedging against the possibility that the EV they buy today will become obsolete in short order as battery technology improves or charging standards change, according to Consumer Reports.

The lessor, or financial institution that mediates the lease agreement with the lessee, can claim the tax credit on the vehicle, Mass told the DCNF. However, the lessor is not obligated to pass that value on to the consumer, and can instead keep the credit’s value for themselves.

One potential outcome is that the lessor could keep the tax credit, meant to incentivize the purchase of domestically-sourced and manufactured EVs, for themselves by leasing foreign-made EVs that would not qualify for the tax credit if purchased outright.

Lessors may be inclined to pass on most of the value to the lessee by offering a discounted lease offer, which makes their deal more competitive or appealing, according to Kiplinger. However, they could still hold on to part of the tax credit’s value for themselves given their ability to set the terms of the lease agreement, and the carveout allows foreign manufacturers to capture the value of tax credits ostensibly designed to favor their American competitors, even if they pass on the full value to a lessee.

The White House did not immediately respond to the DCNF’s request for comment.

Content created by The Daily Caller News Foundation is available without charge to any eligible news publisher that can provide a large audience. For licensing opportunities of our original content, please contact licensing@dailycallernewsfoundation.org