Welfare reform

-

Featured

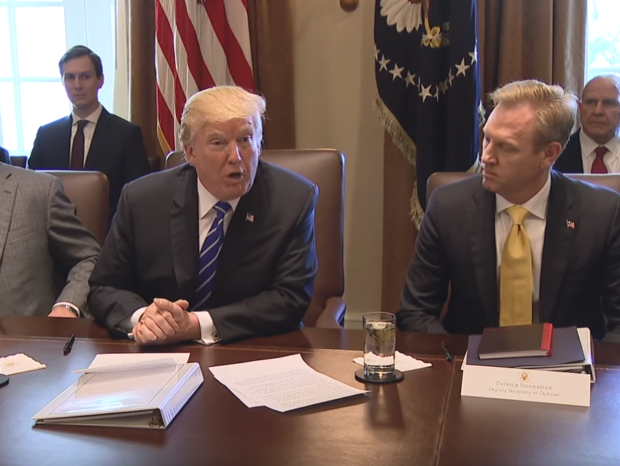

Trump touts giant step towards welfare reform – here’s what that’s about

President Donald Trump said that he had taken “a giant step towards actual welfare reform” hinting that his signing of…

Read More » -

Trending Commentary

Can Republicans Tackle Welfare Reform In 2018?

by Robert Donachie President Donald Trump and Republican leadership spent the weekend at Camp David setting the 2018 legislative…

Read More » -

In The News

Trump to tackle welfare reform, infrastructure next

President Donald Trump announced Monday that his administration would work on welfare once tax reform was completed. “We’ll be working…

Read More » -

Rejecting FairTax Part Four: The Negative Income Tax Credit

In Part One, I’ll cover the dangers of taxing consumption as a major source of government revenue, both to the individual…

Read More »