tax reform

The latest news on the Republican party’s effort to enact the first tax reform since 1986. Full versions of the House and Senate bills, analysis of the bills, vote counts and updates on Congress’ progress to pass the tax reform Americans want.

-

Money & The Economy

Democrats Have Convinced A Majority Of American’s That Trump Didn’t Cut Their Taxes. They’re Wrong

Not even one in ten American taxpayers got a tax increase this year, but a New York Times survey reveals…

Read More » -

Money & The Economy

Tax Refunds Now up 1.3 Percent over 2018, Increase 19 Percent from Last Week

The average American’s tax refunds are up in 2019, according to the U.S. Treasury Department. Mainstream media has reported for…

Read More » -

In The News

Watch: President Trump discusses ‘Tax Reform 2.0’ and Helsinki Summit in meeting with members of Congress

President Donald Trump will meet with members of Congress Tuesday, during which he will discuss strategy on the next stage…

Read More » -

In The News

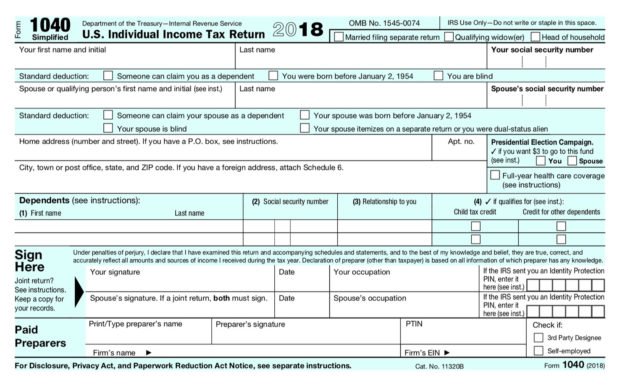

Treasury releases 2018 tax forms and they are much simpler [pics]

The U.S. Department of the Treasury released on Friday images and descriptions of the new 1040 tax return form saying…

Read More » -

In The News

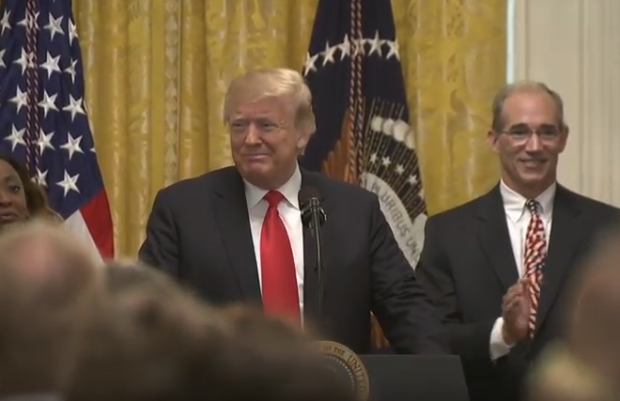

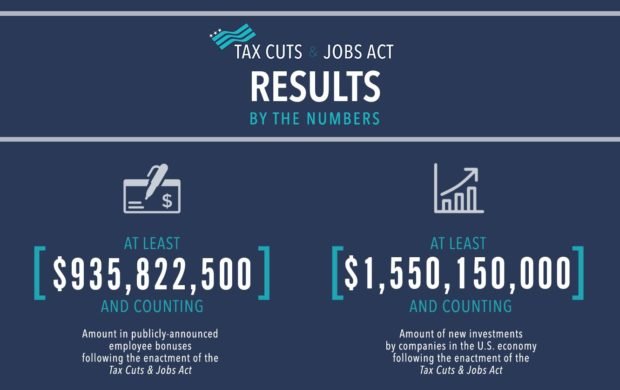

Watch: Trump Delivers Remarks Celebrating the Six Month Anniversary of the Tax Cuts and Jobs Act

President Donald Trump delivered remarks at a White House event celebrating the 6 month anniversary of tax reform.

Read More » -

In The News

Watch: President Trump Hosts a Roundtable Discussion on Tax Reform

Saturday, in Las Vegas, Nevada, President Donald Trump delivers brief remarks and participates in a roundtable discussion with representatives and workers…

Read More » -

In The News

Letter from an Ohio couple to President Trump

Ohio resident, Mrs. Sharlene Thornton, attended a tax event Saturday and she recently wrote a letter to President Trump on…

Read More » -

Trump: We are changing Tax Day for Americans

President Donald Trump wrote an op-ed for USA Today Tuesday in which he said that his administration is “changing Tax Day…

Read More » -

In The News

Watch: Trump Hosts the Tax Cuts for Florida Small Businesses Roundtable [video + transcript]

President Donald Trump hosts a roundtable in Florida to discuss the effects of the tax reforms signed into law earlier…

Read More » -

Money & The Economy

Republican Tax Reform Did Little To Solve US Progressive Tax System

by Robert Donachie The 2017 Republican tax reform bill did little to change the fact that the top 20…

Read More » -

In The News

U-Haul Announces $1,200 Employee Bonuses Thanks to Trump Tax Cuts

Team Members across AMERCO, parent company of U-Haul, will profit from bonus pool of more than $23.6 million PHOENIX, Feb. 9,…

Read More » -

Featured

US Manufacturers’ Response To Tax Cuts? Higher Wages, More Benefits And $500 Million To Charity

by Robert Donachie WASHINGTON, D.C. — U.S. manufacturers are investing in new factories and equipment, hiring more workers, raising…

Read More » -

Thanks to Trump, Apple discovers that America has workers too

After a decade of keeping profits overseas and outsourcing in Asian countries, Apple has suddenly discovered America’s workforce – thanks…

Read More » -

Opinion

Do Liberals Have Any Sense At All?

The New York Times is shocked, shocked! – that they have now determined President Trump’s new tax law will indeed…

Read More »