social security

-

Opinion

Nikki Haley Is Right About Raising Retirement Age to 70

Recently, candidate for the Republican Presidential nomination Nikki Haley suggested that the retirement age be raised. Currently, an individual must…

Read More » -

In The News

Social Security to Become Insolvent Sooner than Previously Projected

Social Security benefits are now projected to be fully paid out only until 2033, one year earlier than previously estimated,…

Read More » -

Opinion

GOP is right: Social security and Medicare must be saved

Recently Congressman Steve Scalise was asked about the GOP plan for Social Security and Medicare. He defended the GOP position…

Read More » -

US News

Laurel DugganOctober 20, 2022

Laurel DugganOctober 20, 2022Social Security Now Allowing People To Choose Their Own Gender, No Questions Asked

The Social Security Administration will allow people to self-select their sex on social security documents without providing legal or medical…

Read More » -

Money & The Economy

John GrimaldiAugust 18, 2022

John GrimaldiAugust 18, 2022Ask Rusty: Can My Wife Claim the Social Security Spouse Benefit First?

Dear Rusty: I have been getting Social Security since age 66. My wife turned 62 in June. We are thinking…

Read More » -

Money & The Economy

Carl FoxJune 22, 2022

Carl FoxJune 22, 2022Millennials’ Social Security Benefits May be Hundreds of Thousands of Dollars Lower than Current Promises

Millennials may well lose hundreds of thousands of dollars in Social Security benefits based on the Social Security Administration’s projection…

Read More » -

Social Security Payments To See Largest Increase In 40 Years

Americans who receive Social Security benefits will see the largest increase in their payments in 40 years, according to the…

Read More » -

Thomas CatenacciSeptember 16, 2021

Here’s What Happens When Medicare, Social Security Run Dry

Two government reports published simultaneously Aug. 31 showed that popular Medicare and social security programs are under serious threat of…

Read More » -

Thomas CatenacciSeptember 1, 2021

Social Security To Run Dry by 2034, Earlier Than Expected

Social Security funds are expected to be depleted by 2034, a year earlier than projected, and the future of the…

Read More » -

Opinion

Millennials and Gen Z Have Serious Concerns about Social Security. Should They?

Not all millennials and Gen Zers trust the government blindly. Many, a Northwestern Mutual study shows, are actually unsure whether…

Read More » -

Dan WeberMay 17, 2019

AMAC warns of more Social Security phone scams

WASHINGTON, DC, MAY 17 – Robocall Social Security Administration scams are on the rise. The Federal Trade Commission [FTC] says SSA…

Read More » -

Syndicated Posts

Rich MitchellMarch 6, 2019

Rich MitchellMarch 6, 2019AMAC Explains How Social Security Survivor Benefits Work

As an answer to a question posed in a letter to the editor, the Association of Mature American Citizens (AMAC)…

Read More » -

In The News

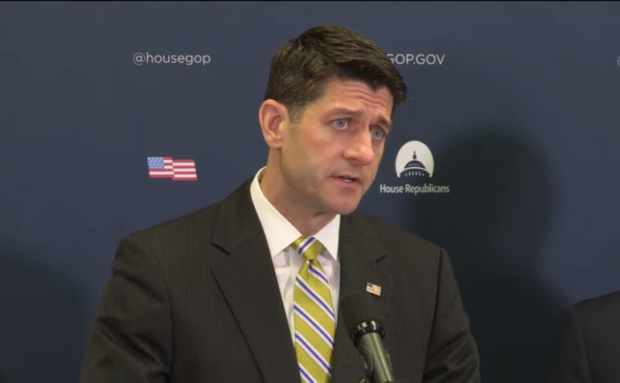

Did Paul Ryan Propose Raising The Retirement Age To 70?

The liberal Facebook page Really American, which has nearly 1 million followers, posted a meme claiming that House Speaker Paul…

Read More » -

Money & The Economy

Rich MitchellDecember 11, 2017

Rich MitchellDecember 11, 2017Hogan: Social Security Won’t Give You Security

If you’re counting on Social Security to finance your retirement, you’re in for a big surprise. Money expert Chris Hogan…

Read More » -

In The News

Social Security Administration Announces 2.0% COLA Increase

The Social Security Administration announced Friday that it will increase Social Security and Supplemental Security Income benefits for more than…

Read More »