Social Justice

-

In The News

Kendall TietzNovember 19, 2021

Kendall TietzNovember 19, 2021Manhattan School Plans To Divide Students By Race During Social Justice Discussions

A Manhattan school plans to separate students by race during discussions scheduled for next week related to identity and social…

Read More » -

Featured

Bryan BabbNovember 18, 2021

Bryan BabbNovember 18, 2021Colorado Considers Dropping The Term ‘Sex Offender’ Because Of ‘Negative Effects’

Colorado officials are set to vote Friday on whether to drop the term “sex offender” to describe people who engaged…

Read More » -

In The News

DOJ Asks Congress For Funding To Fight Domestic Terrorism, Gender Crimes, Systemic Racism

Attorney General Merrick Garland asked Congress for additional funding, which would be used to combat domestic terrorism, gender violence and…

Read More » -

Opinion

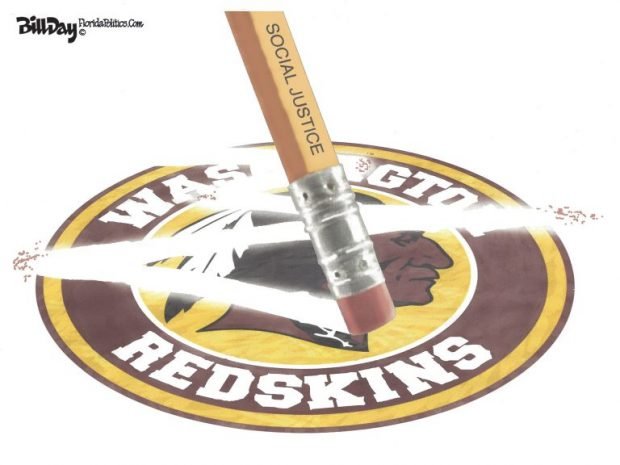

The Only Good Redskin Is a Dead Redskin

It’s more than a bit ironic that over the years Redskins owner Daniel Snyder’s game plan to defend the team’s…

Read More » -

Michael BastaschFebruary 7, 2019

Alexandria Ocasio-Cortez: ‘Green New Deal Is About Social Justice’

The “Green New Deal” isn’t so much about fighting global warming as it is about “social justice,” according to the…

Read More » -

Opinion

Starbucks Seeking Volunteers for Sociology Experiment

Previously, Starbucks’ customer base had its own individual criteria for choosing a favorite coffee spot among the company’s many outlets.…

Read More » -

Opinion

Rich MitchellMay 19, 2017

Rich MitchellMay 19, 2017The Left is Killing Its Own Movement

The left in the U.S. would “go so far as to cannibalize their own movement” in hopes of winning the…

Read More » -

Poverty of the Perfect

By Michael J. Lewinski 12/31/13 A life of poverty is not the legacy any parent would willfully choose for their…

Read More » -

The Unbridled Hate of Hate Speech Laws

“I disapprove of what you say, but I will defend to the death your right to say it.” This quote,…

Read More » -

Now that Pope Benedict XVI has resigned who should replace him?

Pope Benedict XVI sudden resignation brings with it history, health, and heroics. He is the first Pope to resign in…

Read More » -

Fair? Who Ever Said Life Was Gonna Be Fair?

Fair.. a word being thrown about endlessly this political season – especially by our president and the democrats. Fair share…

Read More » -

Opinion

Rich MitchellNovember 24, 2011

Lets Give the Liberals the Tax Hikes They Demand: Thanksgiving Edition

As the sweet aroma of Mom’s pumpkin pie fills the home this Thanksgiving morning, and with the turkey all set…

Read More » -

Rich MitchellAugust 29, 2011

A Brave New World In 1984

The English language is beautiful in its complexity, dangerous beauty. Interpretation is an art in English, enough that you can…

Read More » -

Featured

The Laffer Curve of Slavery

Arthur Laffer presented his now famous principle of taxation as a graph representing the general relationship between tax rates and…

Read More » -

Rich MitchellNovember 26, 2010

Social Justice Sophisticates Assault Prosperity

Leaders that value self determination and independence are denigrated by those who idolize the memory of a former president who…

Read More »