Paul Ryan

-

Watch: Seven Years of Obamacare Is Enough

House Speaker Paul Ryan (R-WI) released a video emphasizing the damaging effects Obamacare has had on jobs, families, health care…

Read More » -

In The News

WATCH: Paul Ryan: Everyone Doesn’t Get What They Want [Full Interview]

Speaker Paul Ryan sits down with Face the Nation Host John Dickerson to discuss the Republican House’s new health care…

Read More » -

Opinion

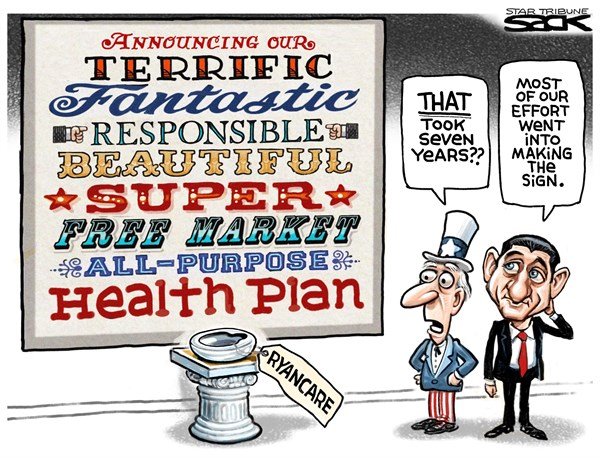

Ryan’s Obamacare Lite Is Another Travesty & Betrayal

Freshman Rep. Moira Walsh had an unusual explanation for some of the bad lawmaking in her state capital during an…

Read More » -

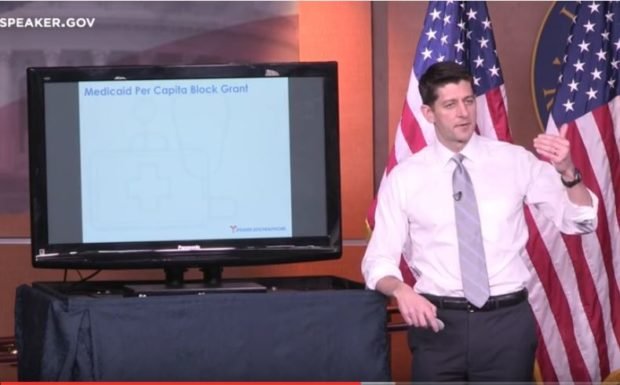

Watch: Speaker Ryan’s Presentation on the American Health Care Act

House Speaker Paul Ryan delivered a live stream presentation on Wednesday morning detailing the process that congressional republicans are using…

Read More » -

WATCH: Speaker Paul Ryan News Conference on American Health Care Act 3-8-17

Tune in live to the @HouseGOP Leadership News Conference where we discuss the American Health Care Act at 10 am…

Read More » -

In The News

GOP Explains Repeal and Replace Strategy as “Repeal with stable transition”

In the weekly House GOP press conference, Speaker Paul Ryan and other GOP leaders explained their approach to repealing and…

Read More » -

WATCH: House Republican Leadership News Conference on Obamacare Repeal

House Speaker Paul Ryan and GOP leaders speak to reporters about the repeal and replacement of Obamacare.

Read More » -

I Was 100 Percent Wrong About Donald Trump

It’s been a decade or more since I’ve enjoyed watching election returns on TV. Republicans are always being told not…

Read More » -

Opinion

The Trump-Ryan Feud and Intraparty Loyalty

The fast-eroding relationship between Speaker of the House Paul Ryan (R-WI) and Donald Trump is about as friendly as the…

Read More » -

In The News

Obama administration intends to use military pay raise as ‘weapon’

In his weekly address, House Speaker Paul Ryan read from a memo showing that the Obama administration intends to turn…

Read More » -

Donald Trump Holds Rally in Green Bay, WI 8/5/16 [full video]

Speaking from notes, Trump's tone was markedly softened as he delivered remarks about uniting the party, bringing all sorts of…

Read More » -

In The News

Speaker Ryan and Donald Trump release joint statement after meeting

Donald Trump and House Speaker Paul Ryan released a joint statement on their websites talking up Thursday’s meeting as “a…

Read More » -

In The News

Paul Ryan to step down as Convention Chair if Trump asks

After House Speaker Paul Ryan met with editorial staff at the Milwaukee Journal Sentinel, one of the Sentinel’s columnists shared…

Read More » -

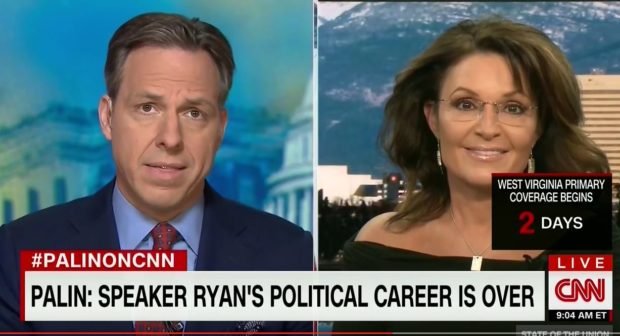

Sarah Palin: Paul Ryan’s Career is over [video]

During a Sunday morning CNN interview, former Alaska Governor Sarah Palin said that because he failed to endorse Donald Trump,…

Read More » -

Is Paul Ryan re-thinking the Presidency? [video]

There has been much speculation as to whether or not Paul Ryan would accept a GOP nod in an open…

Read More »