oil prices

-

Opinion

Rising Oil Prices About to Reignite Higher Inflation

OPEC+ ,which is the 13 original OPEC countries plus 10 more countries including Russia and Canada, has just announced it…

Read More » -

Money & The Economy

High Oil Prices Exacerbated By OPEC+ Cuts Could Push Global Market Into Recession, Analysis Warns

High oil prices that will be pushed up further by the Organization of Petroluem Exporting Countries’ (OPEC) and Russia’s significant…

Read More » -

Money & The Economy

OPEC+ to Cut Oil Production by 2 Million Barrels per Day

OPEC+ announced Wednesday that it will cut oil production by 2 million barrels per day in a move that may…

Read More » -

White House Watch

Biden Admin to Restart Oil & Gas Leasing With Severe Cuts and Higher Fees

The Biden administration said that it would reduce the amount of land it would sell oil and gas leases on…

Read More » -

Money & The Economy

Oil Hits 11-Year High As Big Oil Dumps Russia, White House Mulls Energy Sanctions

The price of crude oil touched its highest level in nearly 11 years on Wednesday amid the ongoing Ukraine crisis…

Read More » -

Money & The Economy

Oil Prices Surge as Demand Spikes, Biden Unwilling to Unleash U.S. Production

Crude oil prices continue their meteoric rise toward $100 per barrel as analysts predict rising demand, and the U.S.…

Read More » -

White House Watch

Biden Admin May Be Negotiating Iran Deal for Wrong Reason

The Biden administration is working to revive a nuclear weapons deal with Iran and it may be doing so with…

Read More » -

Money & The Economy

Biden Effect: Farms Fail As Fertilizer Prices Soar

Soaring fertilizer prices across the globe have impacted farmers making it more expensive to produce food and forcing them to…

Read More » -

Money & The Economy

Oil Prices To Have Another Volatile Year, Top Energy Agency Projects

Oil prices are poised to have another unsteady year as increasing demand, low supply and pandemic uncertainty continue to send…

Read More » -

Oil Prices Skyrocket To Seven-Year High After OPEC Announces Gradual Output Boost

The price of oil surged Monday after the Organization of the Petroleum Exporting Countries (OPEC) doubled down on its plans…

Read More » -

In The News

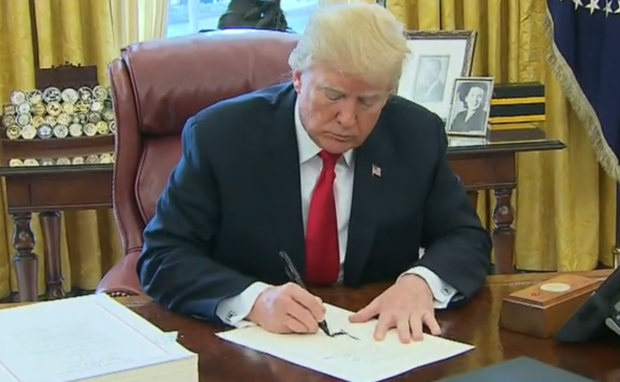

Trump punishes Iran by limiting petroleum purchases

President Donald Trump ordered the federal government to significantly reduce the amount of petroleum and petroleum products purchased from Iran.…

Read More » - Editorial Cartoons

-

Breitling Oil and Gas Announces Exploration in Louisiana

IRVING, Texas, June 14, 2011 — Breitling Oil and Gas Corporation, an independent exploration and production company based in Irving,…

Read More » -

Food and Energy Inflation Is Not Transitory

FORT LEE, N.J., April 28, 2011 /PRNewswire/ — Federal Reserve Chairman Ben Bernanke on Wednesday held his first press conference in history. The press conference…

Read More »