Housing

-

Opinion

Some in Congress Want You to Subsidize Their DC Housing

It was only a matter of time I suppose. Some Progressive-Democrats in Congress are floating a bill to make the…

Read More » -

Money & The Economy

Housing Sentiment Continues to Strengthen, but affordability a concern

The Fannie Mae Home Purchase Sentiment Index® (HPSI)rose 0.6 points in May to 92.3, reaching a new all-time survey high for the…

Read More » -

Money & The Economy

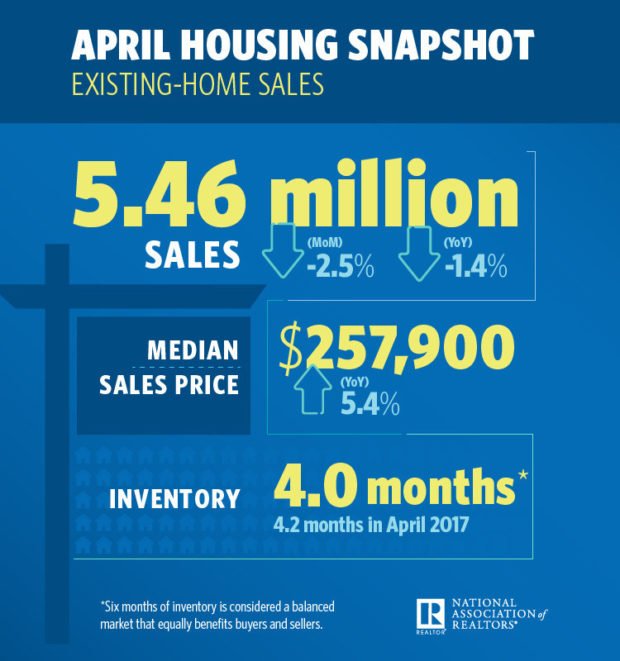

Existing-Home Sales Slide 2.5 Percent in April

After moving upward for two straight months, existing-home sales retreated in April on both a monthly and annualized basis, according…

Read More » -

Money & The Economy

First-Time Homebuyers Pull Back For The First Time Since 2014

A new report released Thursday shows that first-time homebuyers bought fewer homes than the previous year for the first time…

Read More » -

Money & The Economy

Strong Demand Pushes Up New York City Rents Ahead of Peak Rental Season

Ahead of peak rental season, apartment shoppers can expect to see slightly higher rent prices than last year, particularly in…

Read More » -

Opinion

Newt Gingrich's Record: Uncomfortable But True

I’m going to say something uncomfortable to many of you, but it has to be said: Newt Gingrich has a…

Read More » -

Home Sales Follow Seasonal Trend, But Remain Higher Than a Year Ago

DENVER, Nov. 17, 2011 /PRNewswire/ — October home sales were 9.0% above sales in October last year, according to The RE/MAX Monthly…

Read More » -

Fannie and Freddie: Dark Clouds Looming Over Near-Term Outlook

WASHINGTON, Aug. 22, 2011 /PRNewswire/ — The economy was hit by a barrage of disappointing news during the last month, which led…

Read More » -

Mortgage Rates Continue to Fall

CHARLOTTE, N.C. Aug. 17, 2011 /PRNewswire/ — Average mortgage rates continued to fall week-over-week, once again marking the year’s lowest levels according…

Read More » -

Massive Overhang of Existing Homes Putting Downward Pressure on U.S. Home Prices and Demand

LOS ANGELES, June 16, 2011 /PRNewswire/ — A massive inventory of existing homes is dampening the recovery in the U.S. housing sector…

Read More » -

Mortgage Rates Reverse Course

NEW YORK, June 16, 2011 /PRNewswire/ — Mortgage rates increased this week, following a nine-week streak of declines. The benchmark conforming 30-year…

Read More » -

Mortgage Banking Giant Agrees to Pay Homeowner $30,000 as Part of Settlement Agreement

With pending counterclaims of fraud and predatory lending, Deutsche Bank agrees to pay defendant $30,000 and issue a letter to…

Read More » -

Fannie and Freddie Fatcats Still Raking in Taxpayer Dollars. $35M in Bonuses

Fannie Mae and Freddie Mac executives raked in over $35 million dollars in bonuses while sucking another $153 BILLION dollars…

Read More »