federal spending

-

In The News

Trump announces ‘nickel plan’, asks administration heads to cut budgets by 5% or more

President Donald Trump asked the members of his cabinet to cut at least 5% of their budgets for the next…

Read More » -

H.R.6157 – Department of Defense and Labor, Health and Human Services, and Education Appropriations Act, 2019 and Continuing Appropriations Act, 2019 [full text]

AT THE SECOND SESSION Begun and held at the City of Washington on Wednesday, the third day of January, two…

Read More » -

In The News

White House announces rescission package to cut spending by $15.4 billion

White House Office of Management and Budget Deputy Director Russ Vought penned an op-ed piece in the Wall Street Journal…

Read More » -

In The News

White House Is Taking An Axe To Congress’ Massive Spending Spree

by Robert Donachie President Donald Trump’s administration is going to roll out a recision package Monday that will claw…

Read More » -

In The News

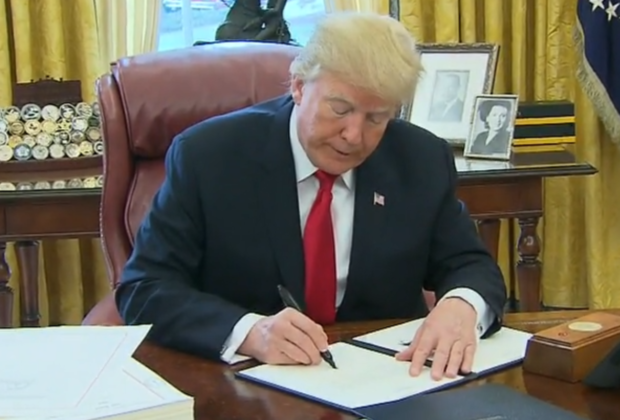

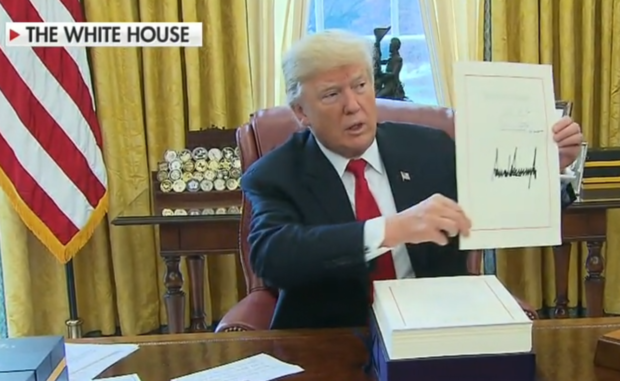

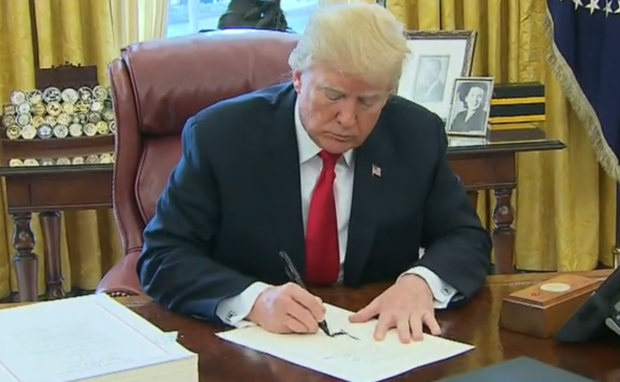

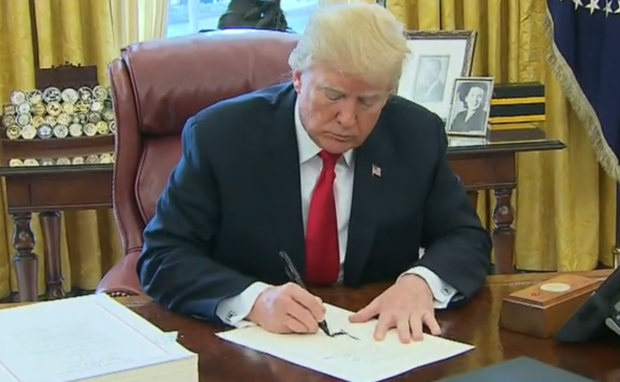

What’s in the 2018 Omnibus Spending Law? H.R. 1625: The Consolidated Appropriations Act, 2018

President Donald Trump signed H.R. 1625: “The Consolidated Appropriations Act, 2018” into law on Friday. The law funds the federal…

Read More » -

In The News

What’s in the budget bill for the military that the president just signed

President Donald Trump signed Friday the Consolidated Appropriations Act, 2018 that lays out funding levels for government agencies and departments…

Read More » -

H.R. 1625 – The Consolidated Appropriations Act, 2018 [full text]

H.R. 1625 was signed into law on March 23, 2018. This bill became the vehicle for passage of the government spending…

Read More » -

In The News

FACT CHECK: Did Lawmakers Have Less Than A Minute Per Page To Read The Omnibus Before Voting?

by Emily Larsen Bloomberg reporter Steven Dennis said Friday that lawmakers had less than a minute per page to…

Read More » -

Opinion

Trump never should have signed the terrible, awful, no good GOP spending bill

H.R. 1625 – the omnibus bill – is an awful piece of legislation that was rushed through in the dark of…

Read More » -

In The News

Watch: Trump Signed $1.3 Trillion Omnibus Bill; Not Happy About It [video + transcript]

President Donald Trump signs the $1.3 trillion omnibus bill just hours after tweeting that he was considering vetoing the measure.…

Read More » -

Featured

6 Things That Will Make Conservatives Livid In The Spending Bill

by Robert Donachie House leadership released the text of a 2,232 page must-pass spending bill late Wednesday evening that…

Read More » -

Featured

What’s in the budget bill that President Trump just signed

President Donald Trump signed a new budget bill, H.R. 1892, into law on Friday that pushes most of the difficult…

Read More » -

H.R. 1892 – The Bipartisan Budget Act of 2018 [full text]

also available in PDF format In the Senate of the United States, February 9 (legislative day, February 8), 2018. Resolved, That…

Read More » -

In The News

Trump: ‘Our country needs a good shutdown’

President Trump said Tuesday that a government shutdown might be the only way to fix the mess in Washington. The…

Read More » -

HONOR OUR FALLEN HEROES; An Oath Keeper’s Plea

Today is Memorial Day. During the course of the day many words, like these, will be written; many parades…

Read More »