The CBO

-

Opinion

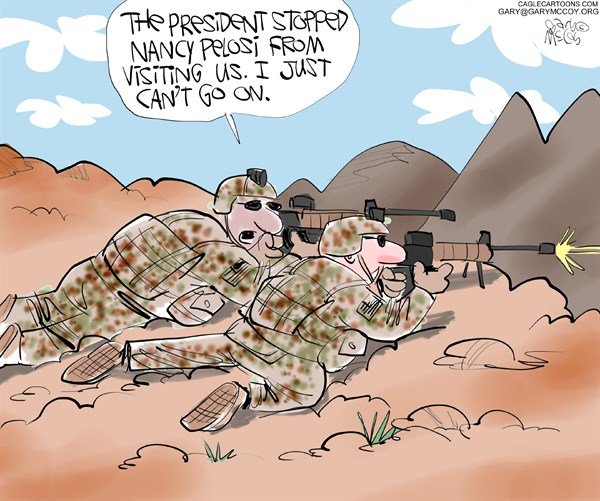

That Long Winter at Valley Shutdown

The long winter at Valley Shutdown is evidently growing more dire for federal employees. They have now missed their FIRST…

Read More » -

US News

CBO Suggests $1 Trillion Carbon Tax As France Reels From Anti-Carbon Tax Riots

The Congressional Budget Office suggested a $1 trillion carbon tax to help plug the budget deficit. Their report comes as…

Read More » -

In The News

CBO: GOP Health Plan Will Bring Stability, Lower Costs – or not

The non-partisan Congressional Budget Office (CBO) released its report on the republican’s replacement for Obamacare saying that the American Health…

Read More » -

Opinion

ObamaCare: More Taxes, Less Medicare

Today, RepublicanSenate.gov published the highlights of the CBO’s updated report on the costs of Obamacare. Over one trillion dollars will be…

Read More » -

CBO Analysis of August 1 Budget Control Act

On August First, the Congressional Budget Office (CBO) released this summary of its analysis of the debt limit compromise legislation…

Read More » -

Why You Should Care About the CBO Report – Really This Time

The non-partisan Congressional Budget Office (CBO) produced the most-recent version of it’s periodic report on the state of the nation’s…

Read More » -

Are we on the verge of an Economic Collapse?

Are we on the verge of an Economic Collapse? In my opinion yes, and it is intentional, but I’ll let…

Read More »