Money & The Economy

News on Finance, Money, markets and the economy

-

Layoffs Surge To 14-Month High As Inflation Crushes Employers

The number of people laid off from American companies reached the highest point since January 2023, according to data from…

Read More » -

Prices In Key Insurance Sector Could Climb Even Higher After Baltimore Bridge Disaster

The recent collapse of Baltimore, Maryland’s, Francis Scott Key Bridge threatens to raise reinsurance prices for insurance companies, which could…

Read More » -

April Fools: Minimum Wage Increases to $20

Starting on April Fool’s Day, the minimum wage for all workers in the fast-food industry in California will increase to…

Read More » -

Home Costs Rising Twice As Fast As Americans’ Incomes

The cost to afford a median-priced home has increased at twice the rate that the average household income has risen…

Read More » -

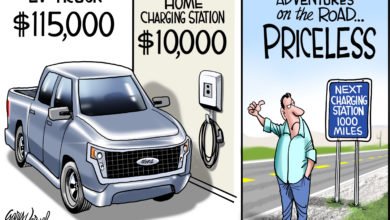

Top Chinese EV Maker Posts Massive Profits Amid Quest To Sneak Into US Market

BYD, China’s top electric vehicle (EV) maker, recorded a substantial increase in profits in its 2023 annual report published on…

Read More » -

Home Prices Rose At Fastest Pace In More Than A Year As Unaffordability Crisis Persists

The index for home prices increased in January at its fastest rate since November 2022 as supply constraints and inflation…

Read More » -

Stellantis To Lay Off Hundreds Of Employees As Electric Vehicle Struggles Continue

Stellantis, the maker of American vehicle brands Dodge, Ram, Chrysler, and Jeep, announced Friday that it will soon lay off…

Read More » -

No Rate Cuts This Year. Maybe a Couple of Hikes.

The Federal Reserve’s Open Market Committee is holding their March meeting today. At the end of last year, most investors…

Read More » -

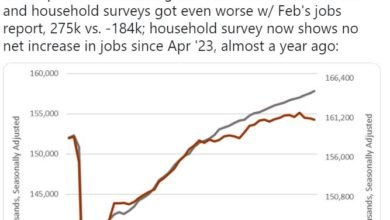

Huge Discrepancy In Jobs Data Could Be Making Biden’s Economy Look Way Stronger On Paper

Data from the Federal Reserve Bank of Philadelphia estimates that the U.S. economy added more than two-thirds fewer jobs in…

Read More » -

Real Estate Group Reaches Deal That Could Cause Massive Change To How Americans Buy Homes

The National Association of Realtors (NAR), a trade association for the real estate industry, announced a massive settlement on Friday,…

Read More » -

Another Inflation Metric Comes In Hot As Price Hikes Show No Sign Of Stopping

The producer price index (PPI) rose more than double expectations in February as inflation continues to run hot despite anticipation…

Read More » -

Biden budget? Tax and spend, here we go again

President Biden has proposed his budget for fiscal year 2025. This proposal will increase government spending by more than 12%…

Read More » -

Biden Added One-Third Less Jobs In January Than Previously Reported

The government overestimated the number of jobs added to the U.S. economy by more than one-third in January, continuing the…

Read More » -

Boeing Whistleblower Rips Company Executives For Ignoring ‘Absolute Chaos’

Ed Pierson, an ex-Boeing senior manager and whistleblower, criticized the company’s executives on Friday for not heeding his warnings about…

Read More » -

Gov’t Jobs Continue To Swell Under Biden As Unemployment Ticks Up

The U.S. set another new record for the total number of government jobs in February, even as overall unemployment ticks…

Read More »