Thought You Heard it All About the IRS?

I am not known among my acquaintances as being in favor of anything the IRS does, from it’s conception onward. However, I recently learned something that was genuinely surprising to me about the IRS, and did something I didn’t conceive as possible. It made my contempt for the IRS actually increase.

The IRS, according to a recently concluded investigation gave 132,000,000,000, billion dollars over the last ten years to people in the form of tax credits, via the Earned Income Credit, that they did not legally qualify for. Over 13 billion dollars a year paid to people who were not supposed to receive the money. Over 10,000 cases in a review of 60,000, had improper payments sent to them! If that wasn’t bad enough, the IRS not only admits this is true, the estimate by the review for this year is that another 12 billion will at go the same route! But wait for it… The real kicker is this. The IRS essentially says not only is there little they could do about it if they cared, they don’t care and aren’t going to do anything about it!

Understand for clarity’s sake here that this money was paid by taxpayers to the IRS in the first place! That’s by you and me folks, out of our paychecks and not reaching the people it should reach, but rather being given to those who do not qualify to receive an EIC in the first place! The EIC is, as Bryon York explained to Greta Van Susteran of Fox News, “A poverty program,” designed to decrease the tax load on certain poor individuals and families. The fact is those who did not meet the requirements to be considered legally “poor” received money they were not entitled to get!

Perhaps the only thing more pitiable than the situation I just described is the reason given by the IRS as to why they won’t do anything about this. They state that if they did it just might discourage those who do qualify for the EIC from applying! To think that these are the people who have been chosen to administer enforcement of Obamacare mandates should make even the most ardent supporter of socialist government cringe.

Lest you believe that your trusty federal government isn’t aware of this egregious situation, a federal directive was given to the IRS in 2009 to fix this specific problem. It is the response to that directive by the IRS which revealed why they were ‘reluctant’ to fix this problem, and apparently the federal government (read President Obama) agrees with them! For there has been no admonishment to the IRS to carry out this directive in the four years hence.

However, one should not be so hasty as to lay blame on the Obama administration for this situation in the IRS. Remember that the investigation concerning this problem of improper payments of tax credits spans 10 years that we know of. This has been going on for at least part of the tenure of G.W. Bush and through President Obama, and likely through other presidents farther back and with other “poverty” programs administered by the IRS. We only know of 10 years because that is as far back as the investigation went. The problem lies not with any particular presidential administration but with the agency itself. The IRS is simply too powerful. Yes, it is legally bound to comply with directives from the President through the Treasury. But an entity whose own regulations carry the force of law, like the IRS, is free to essentially make new law and enforce it without having to wait for the pesky legislature or the president to do it. Therefore it is, through its own power to make and enforce law, able to effectively ignore directives as well. Should there be an investigation as a result of the agency ignoring or simply deciding not to carry out the directives, well, you have seen the response. The IRS basically said, “We understand but we disagree therefore we are not going to do anything about it.”

Such arrogance is but one more reason the IRS needs to be dissolved and certainly should not be trusted with enforcing the mandates of Obamacare! What we need is someone in charge who will have the determination not to reform the tax code but to replace it with a flat or fair tax or a combination such as the 999 plan of Herman Cain. It is long past time to send the entire IRS packing folks, and this is what the best result of the latest “investigation” into its conduct should be.

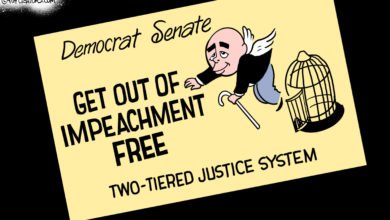

The IRS, buying votes with other people’s money…

The new IRS:

Income

Redistribution

Service