A “Quick and Dirty” Look at Obama’s Tax The Rich Plan

I couldn’t resist. I saw the following article and I just had to write about it: https://money.cnn.com/2012/11/14/news/economy/obama-taxes-deficit/index.html?hpt=hp_t3

Yes, I know that in the post-2012 election era, my blog will naturally pivot to more philosophical writings, but some economic analyses will come up here and there. This is an example of one of these economic analyses.

As many readers of my blog know, rarely would I conduct an analysis on a simple article such as the one listed above. Usually, as seen in this previous analysis, I prefer digging deeper and analyzing primary-source data… usually involving IRS data tables, OMB information, or anything of the like. Since this is a simple analysis of the second-hand information discussed in an article, it is officially a “quick and dirty” look.

The CNN Money article talks about Obama’s hard-line plan on raising taxes on the wealthy. At the bottom, it goes on to list the various increases in revenue for each tax-raising move. Keep in mind, these revenue figures summed up over a period of 10 years. They are:

– Letting the Bush-Era Tax Cuts Expire for High-Income Earners: $1 trillion in revenue raised over the next decade

– Limiting Tax Breaks (and, I’ll assume deductions): $500 billion in revenue raised over the next decade

– Increase Carried Interest Tax Rates: $13.5 billion in revenue raised over the next decade

– Imposed the Millionaire Minimum Tax (the “Buffett Rule”): $47 billion in revenue raised over the next decade

– Enact Business Tax Proposals: Though not explicitly clear, this would raise $240 billion in revenue raised over the next decade

Now, using simple math, these five main tax increases raise $1.8 trillion in revenues over the next decade. If divided equally over 10 years, that’s $180 billion per year. To put this in contrast, the budget deficit for Obama’s 2013 budget is between $909 billion and $1.1 trillion, depending on whose estimate you’re looking at. For conservative numbers sake, we will use the $909 billion value, and we can see that by enacting ALL the tax hikes Obama wants, he would be shrinking the 2013 budget deficit by a very small amount. In 2013, should all these tax increases work like Obama has said they would, our government would still have a $729 billion deficit. Basically, as stated numerous times throughout this blog, increasing taxes on the wealthy does very little to close the deficit. While it does have a small benefit with respect to direct revenue increases, the negative effects of increased expenses on job creators and small business owners will hurt employees’ pockets, ultimately slowing down the economy further.

There is another part of this proposal Obama has promised: spending cuts. So far, I’ve only looked at the revenue side of this plan. It’s time to look at the spending cut side. Examining the CNN article, Obama claims he will cut $4 trillion from the federal budget over 10 years. This is obviously an average savings of $400 billion per year.

Let’s now take a look as to how this all plays out. The following figures are simple linearly-extrapolated numbers based on the conditions we know currently exist in the 2013 budget:

For 2013 – Government expenditures: $3.808 trillion / Government revenues: $2.902 trillion.

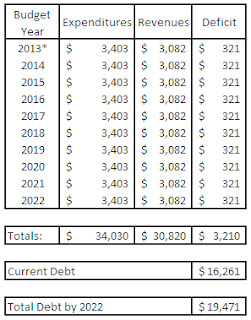

According to Obama’s $400 billion per year spending cut savings, let’s assume the government will then spend about $3.4 trillion per year over the next 10 years (granted this is difficult to predict since entitlements such as Social Security and Medicare are expected to rise in cost due to the aging population). Let’s also assume that the government, based on the $180 billion per year increase in tax revenue, will take in $3.083 trillion per year over the next 10 years. The budget situation would look something like this (all dollar figures are in trillions of dollars):

*Based on current budget estimates

Again, it must be stated that assuming expenditures and revenues stay the the same year after year is a tough sell, but, being that all this discussion centers on estimated spending cut savings and estimated revenue increases, it’s semi-safe to say that this chart displays a good approximation of average values. Notice that even with $400 billion per year in spending cut savings factored in with $180 billion per year in additional revenues, significant deficits remain, and more importantly, the total national debt still balloons to over $19 trillion in 10 years. Unfortunately, as the population ages, expenditures are going to rise, and as the economy declines further because of exogenous forces like slow economic growth worldwide and endogenous forces like business-stifling tax increases, revenues are going to shrink. This chart shows very optimistic scenarios, and realistically, it’s doubtful that if passed as Obama wants it, this spending cut and tax increase plan will produce deficits smaller in size than the ones shown here.

In short, though this is a “quick and dirty” look at Obama’s budget plan proposal, it leads me back to the original conclusion: increasing taxes will do little to help our budget, and spending decreases via entitlement reform are really the budgetary remedy this country needs. If nothing is done soon, as time goes on, our entitlement spending will swallow us further into the black hole of debt oblivion.

To view the original post and see its follow-up comments, visit The Elephant in the Room: https://loudmouthelephant.blogspot.com/2012/11/a-quick-and-dirty-look-at-obamas-tax.html