More Green Energy Company Layoffs

Here we go again. Today, layoffs. Tomorrow, bankruptcy? Another “green energy” company, Abound Solar, a recipient of a $400 million American Recovery and Reinvestment Act (ARRA, or the stimulus) loan guarantee, announced on Tuesday, February 28, 2012, that it is laying off 70% of its workforce, halt what Abound calls first generation solar panel production, refit its manufacturing lines to produce more efficient panels, and delay the construction of a manufacturing plant in Indiana. Abound says it will resume production by year-end with cadmium-telluride panels that will be able to convert 12.5% to 13% of the energy in sunlight into electricity, while its current first generation panels have conversion efficiency rates of 10.5%. This move, says Abound CEO Craig Witsoe and CFO Stephen Abely, will allow it to be more competitive in today’s solar panel market.

Abound has already drawn $70 million of its $400 million credit line, and cannot draw more until it resumes production. Uh oh, more taxpayer money to waste, I mean, to use to support Abound. At least Abound won’t be able to draw any more taxpayer money until it resumes production.

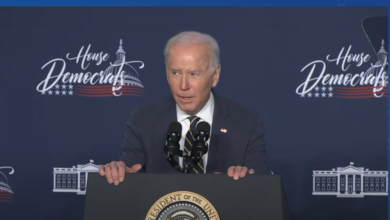

This is the same Abound Solar that President Barack Hussein Obama touted by name in July, 2010, to extol his stimulus’ support for the solar industry. Obama said that Abound would “create more than 2,000 construction jobs and 1,500 permanent jobs,” and would be integral to his administration’s quest to “create whole new industries and hundreds of thousands of new jobs in America.”

This is the same Abound Solar that, when it received the loan guarantee, said it would create 1,500 jobs in Loveland, Colorado and Tipton, Indiana. Abound even received, in 2010, an Indiana Economic Development Corporation $12 million performance-based tax credit. Eighteen months later, and still no Abound Solar jobs for Indiana. At least in Indiana, Abound received a performance-based tax credit, so at least Indiana taxpayers didn’t lose money.

Department of Energy (DOE) spokesman Damien LaVera said, “While the challenges facing solar manufacturers have been widely reported, we continue to believe that supporting innovative companies like this is important to ensuring our nation has the ability to compete for the clean energy jobs of tomorrow.” The pertinent questions are: (1) Will tomorrow ever come? and (2) Can we taxpayers afford to continue to support innovative companies while waiting for tomorrow?

Just so you know, a bankruptcy auction of Solyndra assets, held on Wednesday, November 2, 2011, generated sales of $3.81 million, or less than 1% of the federal financing. Solyndra got $500 million of taxpayer money. After the auction, there was still over $496 million of the money Solyndra lost to be repaid, mostly to taxpayers. As Solyndra began to fail, the White House allowed a restructuring of the debt that ignored rules that applied to non-taxpayer subsidized companies and allowed private creditors to stand ahead of taxpayers for repayment of the first $75 million. DOE’s legal position on creditor and taxpayer repayment is without precedent in the history of its loan guarantee program. Heritage Global Partners, the company that conducted the auction, said that the money raised “will not be anywhere near” $75 million, meaning the proceeds will go entirely towards repaying Solyndra’s private investors. So after paying off creditors, we taxpayers are still out $421 million. An Obama bet with our money that didn’t pan out.

But that’s just my opinion.